The current market focus is on tariffs, so although we get a couple of top tier data points today, the market might ignore them altogether. In the European session we have the Eurozone CPI and the Final PMIs readings.

In the American session, we have the US ISM Manufacturing PMI and the Fed SLOOS, but the focus will be on Trump's talks with Canada and Mexico even though he said to not expect much.

10:00 GMT - Eurozone January Flash CPI

The Eurozone CPI Y/Y is expected at 2.4% vs. 2.4% prior, while the Core CPI Y/Y is seen at 2.6% vs. 2.7% prior. The inflation data we got from France and Germany on Friday showed further easing and saw the market adding to rate cuts bets for the ECB. The market expects at least three more rate cuts by the end of the year which could increase in case Trump goes hard on tariffs.

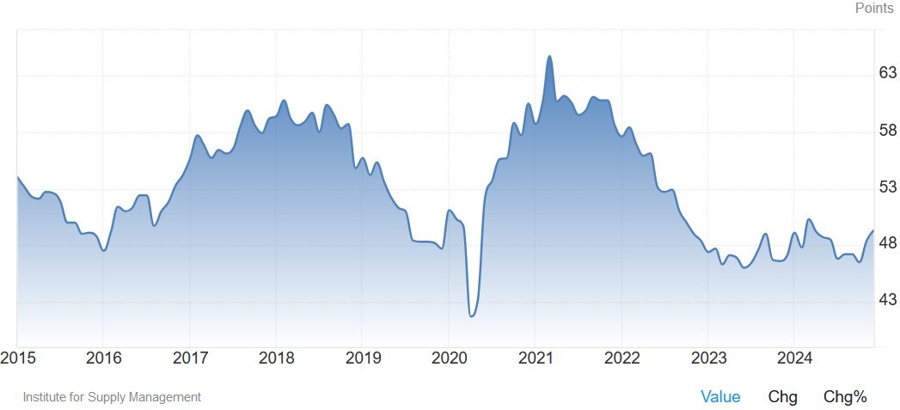

15:00 GMT/10:00 ET - US January ISM Manufacturing PMI

The US ISM Manufacturing PMI is expected at 49.8 vs. 49.3 prior. The expectations are skewed to the upside following the US S&P Global Manufacturing PMI returning in expansion with an upbeat commentary from the agency saying that “the US businesses are starting 2025 in an upbeat mood on hopes that the new administration will help drive stronger economic growth.

“Rising optimism is most notable in the manufacturing sector, where expectations of growth over the coming year have surged higher as factories await support from the new policies of the Trump administration, though service providers are also entering 2025 in good spirits.”

Central bank speakers:

- 17:30 GMT/12:30 ET - Fed's Bostic (non voter - hawk)

- 23:30 GMT/18:30 ET - Fed's Musalem (voter - neutral)