In the European session, the focus will be on the French and German CPI figures ahead of the Eurozone Flash CPI report next week. In the American session, the attention will switch to the Canadian GDP, the US Core PCE and the US Employment Cost Index.

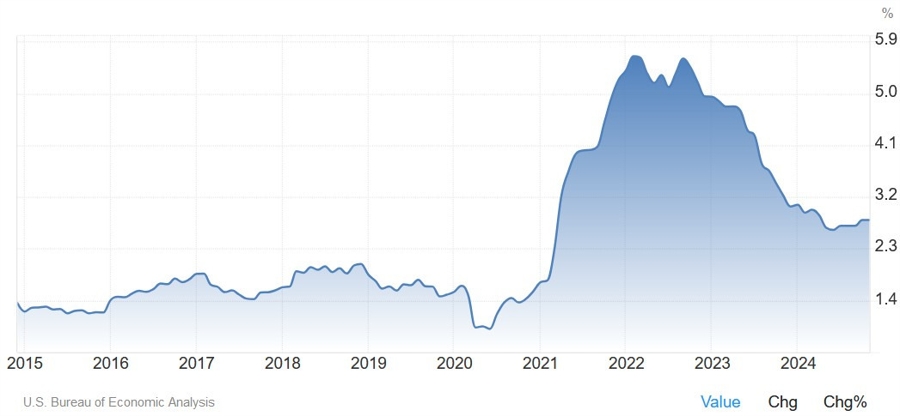

13:30 GMT/08:30 ET - US December PCE Index

The US PCE Y/Y is expected at 2.6% vs. 2.4% prior, while the M/M measure is seen at 0.3% vs. 0.1% prior. The Core PCE Y/Y is expected at 2.8% vs. 2.8% prior, while the M/M figure is seen at 0.2% vs. 0.1% prior.

Forecasters can reliably estimate the PCE once the CPI and PPI are out, so the market already knows what to expect. Therefore, unless we see a deviation from the expected numbers, it shouldn’t affect the current market’s pricing.

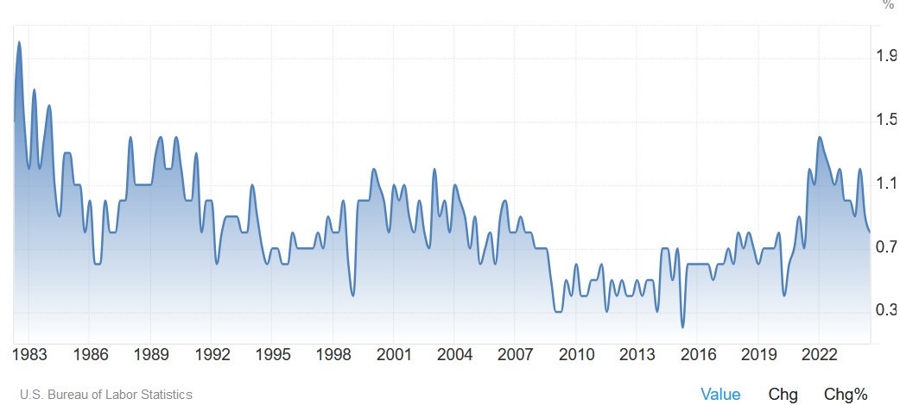

13:30 GMT/08:30 ET - US Q4 Employment Cost Index

The US Q4 Employment Cost Index (ECI) is expected at 0.9% vs. 0.8% prior. This is the most comprehensive measure of labour costs, but unfortunately, it’s not as timely as the Average Hourly Earnings data. The Fed though watches this indicator closely.

Central bank speakers:

- 13:30 GMT/08:30 ET - Fed's Bowman (voter - hawk)