Today is going to be the busiest day of the week in terms of risk events on the agenda. The highlights include the ECB Rate Decision, the US Jobless Claims and the US PPI.

12:15 GMT/08:15 ET - ECB Policy Decision

The ECB is expected to cut by 25 bps and bring the policy rate to 3.50%. This rate cut has been strongly telegraphed since July. After today's rate cut, the market expects the central bank to deliver at least another 25 bps cut by year-end. Athough President Lagarde might not explicitly pre-commit to a back-to-back cut in October, she might keep such an option on the table "depending on the data".

12:30 GMT/08:30 ET - US Jobless Claims

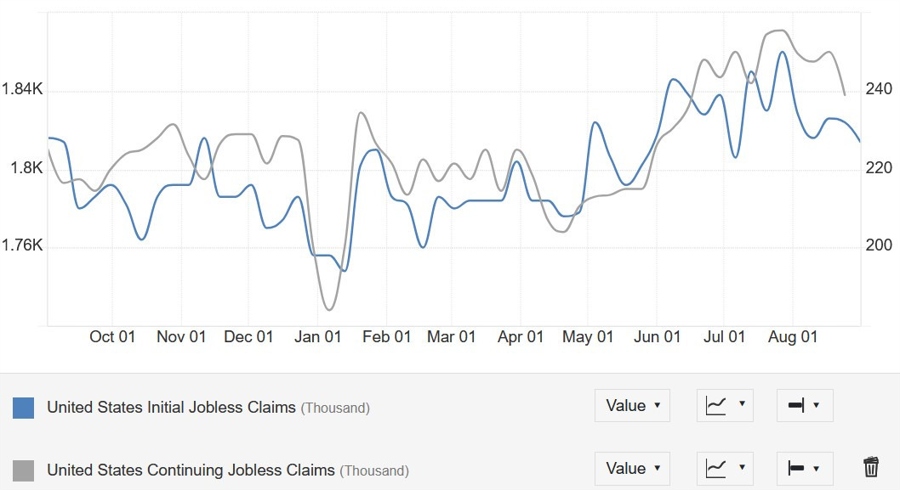

The US Jobless Claims continues to be one of the most important releases to follow every week as it’s a timelier indicator on the state of the labour market.

Initial Claims remain inside the 200K-260K range created since 2022, while Continuing Claims have been on a sustained rise (although they’ve improved recently) showing that layoffs are not accelerating and remain at low levels while hiring is more subdued.

This week Initial Claims are expected at 230K vs. 227K prior, while Continuing Claims are seen at 1850K vs. 1838K prior.

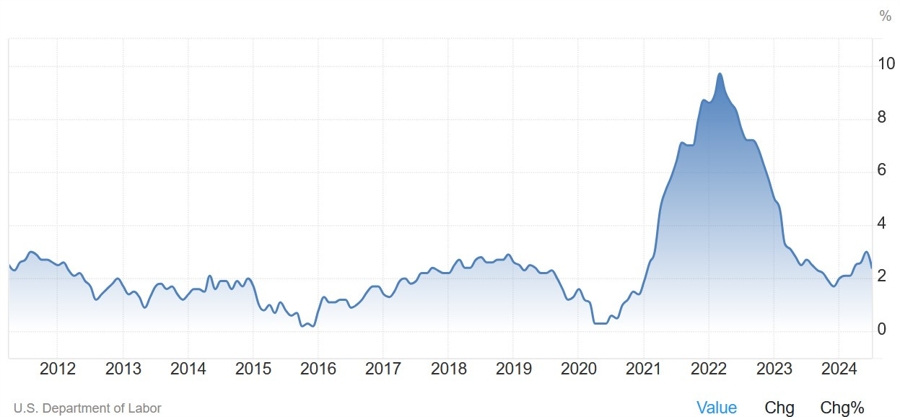

12:30 GMT/08:30 ET - US August PPI

The US PPI Y/Y is expected at 1.8% vs. 2.2% prior, while the M/M measure is seen at 0.1% vs. 0.1% prior. The Core PPI Y/Y is expected at 2.5% vs. 2.4% prior, while the M/M figure is seen at 0.2% vs.0.0% prior.