The European session is once again empty and all the focus will be on the US CPI report in the American session. Inflation data is now less important than the labour market and growth data, but it could still have a say in the market's pricing, especially for the next week's FOMC decision.

12:30 GMT/08:30 ET - US August CPI

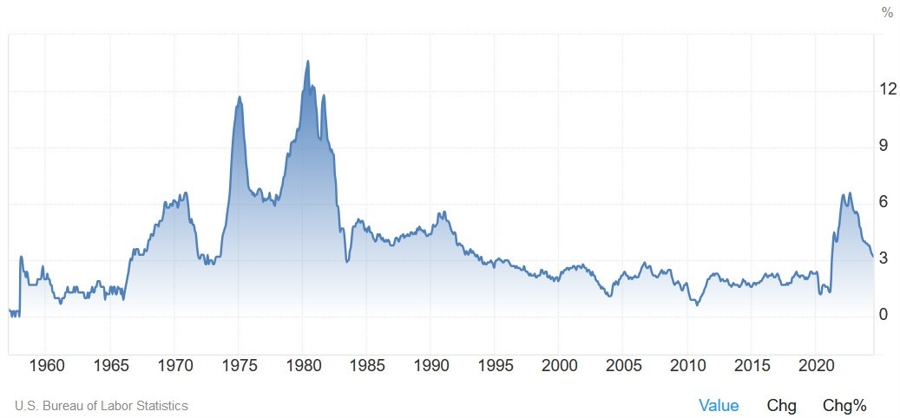

The US CPI Y/Y is expected at 2.6% vs. 2.9% prior, while the M/M measure is seen at 0.2% vs. 0.2% prior. The Core CPI Y/Y is expected at 3.2% vs. 3.2% prior, while the M/M figure is seen at 0.2% vs. 0.2% prior.

The Fed is now focused on the labour market, and they’ve even stated that upside surprises in inflation won’t change their overall outlook. Therefore, inflation reports have less significance at the moment although I’d say that a soft report will likely push the expectations for a 50 bps cut back around 50% as it would give the Fed a stronger excuse to deliver a 50 bps insurance cut.