Today all eyes will be on the US NFP report. There is some fear in the markets following yesterday's ugly ISM Manufacturing PMI, so if we get an ugly NFP report we might see widespread risk-off. The market has fully priced in three rate cuts by the end of the year with chances of a 50 bps cut in September rising by the day.

12:30 GMT/08:30 ET - US July Non-Farm Payrolls

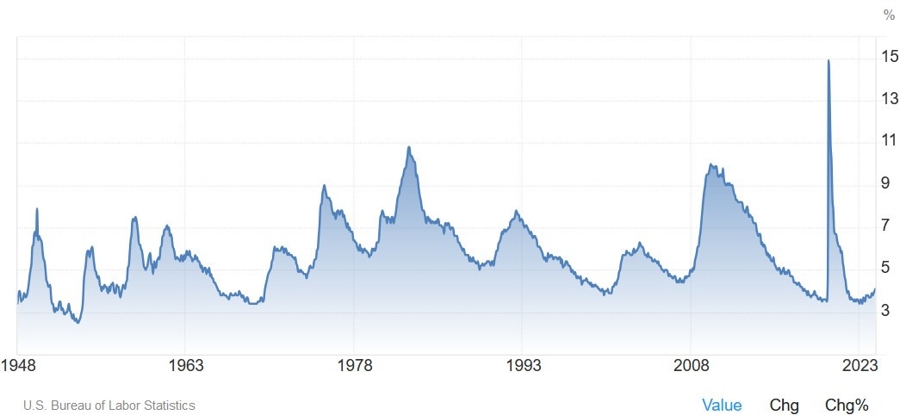

The US NFP is expected to show 175K jobs added in July vs. 206K in June, and the Unemployment Rate to remain unchanged at 4.1%. The Average Hourly Earnings Y/Y is expected at 3.7% vs. 3.9% prior, while the M/M measure is seen at 0.3% vs. 0.3% prior. The Fed at the moment is very focused on the labour market as they fear a quick deterioration.

As a reminder, the Fed forecasted the unemployment rate to end the year at 4%, so I can see them getting uncomfortable if unemployment rises to 4.2%. The market might raise further the chances of a 50 bps rate cut in September. For now, the data suggests that the labour market is rebalancing via less hires rather than more layoffs as we have also seen with the latest US Job Openings data where the layoffs and hires rates both fell.

The last report was relatively softer than expected but still a decent one. The uptick in the unemployment rate at first impact was perceived as bad news, but looking at the details it wasn’t as bad. In fact, the entire increase in unemployment during the first half of 2024 has been due to new entrants and re-entrants, and not layoffs. For more information about the last report click here.