There are no notable releases in the European session as we just get the Final readings of the PMIs. The focus will be mainly on the BoE Policy Decision where the expectations are skewed for a rate cut. In the American session, we have the US Jobless Claims, the Canadian Manufacturing PMI and the US ISM Manufacturing PMI.

11:00 GMT/07:00 ET - BoE Policy Decision

The market is assigning a 60% probability of a 25 bps rate cut for the BoE, bringing the Bank Rate to 5.00% from the current 5.25% level. The expectations look misplaced given the recent comments from BoE's Pill and the economic data.

The BoE’s chief economist Huw Pill said that it was an open question of whether the time for a rate cut was now or not and added that more data will come before the next policy decision, but they had to be realistic about how much any one or two releases could add to their assessment.

This suggested that there wasn’t much willingness to deliver the first cut in August unless the inflation data came out extremely good or the jobs data showed an extremely ugly picture. Well, the latest UK CPI wasn’t good as the Core figure and the Services inflation remained unchanged. On the labour market side, the latest report was mostly in line with expectations with wage growth remaining elevated.

12:30 GMT/08:30 ET - US Jobless Claims

The US Jobless Claims continue to be one of the most important releases to follow every week as it’s a timelier indicator on the state of the labour market.

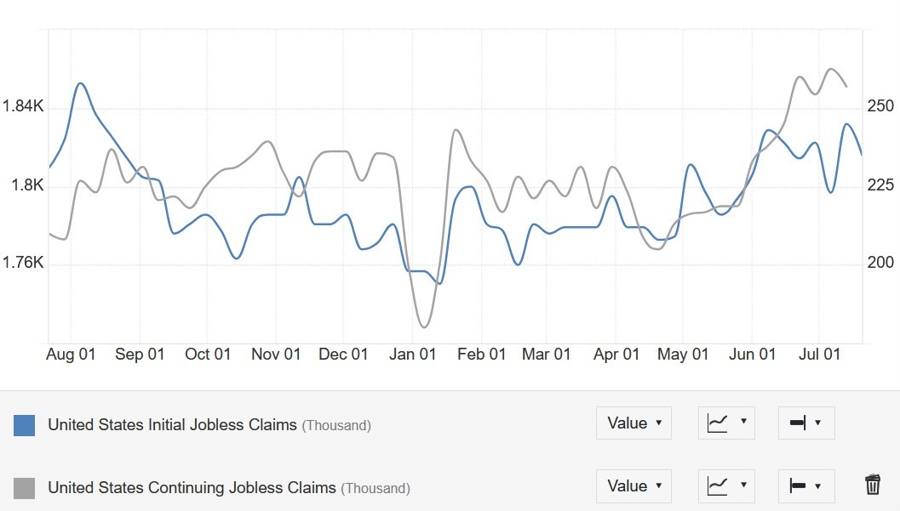

Initial Claims remain pretty much stable around cycle lows and inside the 200K-260K range created since 2022. Continuing Claims, on the other hand, have been on a sustained rise, although they have stabilised more recently.

This shows that layoffs are not accelerating and remain at low levels while hiring is more subdued. This is something to keep an eye on. This week Initial Claims are expected at 236K vs. 235K prior, while Continuing Claims are seen at 1860K vs. 1851K prior.

14:00 GMT/10:00 ET - US July ISM Manufacturing PMI

The US ISM Manufacturing PMI is expected at 48.8 vs. 48.5 prior. Last week, the S&P Global US Manufacturing PMI slipped to 49.5 from 51.5 prior, although the commentary was largely positive.

The survey brought some more welcome news in terms of inflation stating that “the rate of increase of average prices charged for goods and services has slowed further, dropping to a level consistent with the Fed’s 2% target".

On the negative side, “both manufacturers and service providers are reporting heightened uncertainty around the election, which is dampening investment and hiring” and “input costs rose at an increased rate, linked to rising raw material, shipping and labour costs. These higher costs could feed through to higher selling prices if sustained or cause a squeeze on margins”.