Now that the UK labour market report is out of the way, the only notable event left in the European session is the ECB policy decision. Moving on to the American session, the latest US Jobless Claims figures will be the most important release of the day.

12:15 GMT/08:15 ET - ECB Policy Decision

The ECB is expected to keep interest rates unchanged at 3.75%. The central bank speakers said countless times that they are not going to do anything in July as they want to wait for more data. Therefore, this is going to be a non-event and the next truly open meeting is in September. The market is seeing an additional 46 bps of easing by year-end.

12:30 GMT/08:30 ET - US Jobless Claims

The US Jobless Claims continue to be one of the most important releases to follow every week as it’s a timelier indicator on the state of the labour market.

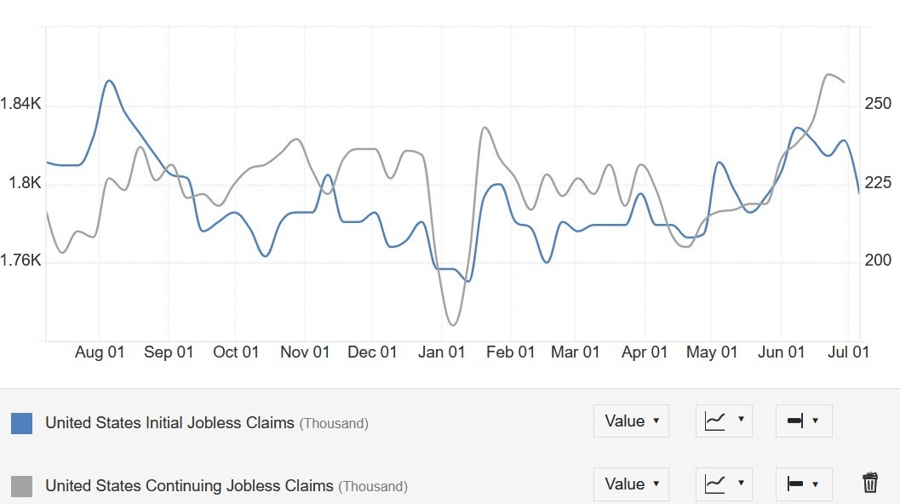

Initial Claims remain pretty much stable around cycle lows and inside the 200K-260K range created since 2022. Continuing Claims, on the other hand, have been on a sustained rise recently with the data printing new cycle highs every week (although last week we saw a pullback).

This shows that layoffs are not accelerating and remain at low levels while hiring is more subdued. This is something to keep an eye on. This week Initial Claims are expected at 230K vs. 222K prior, while Continuing Claims are seen at 1855K vs. 1852M prior.