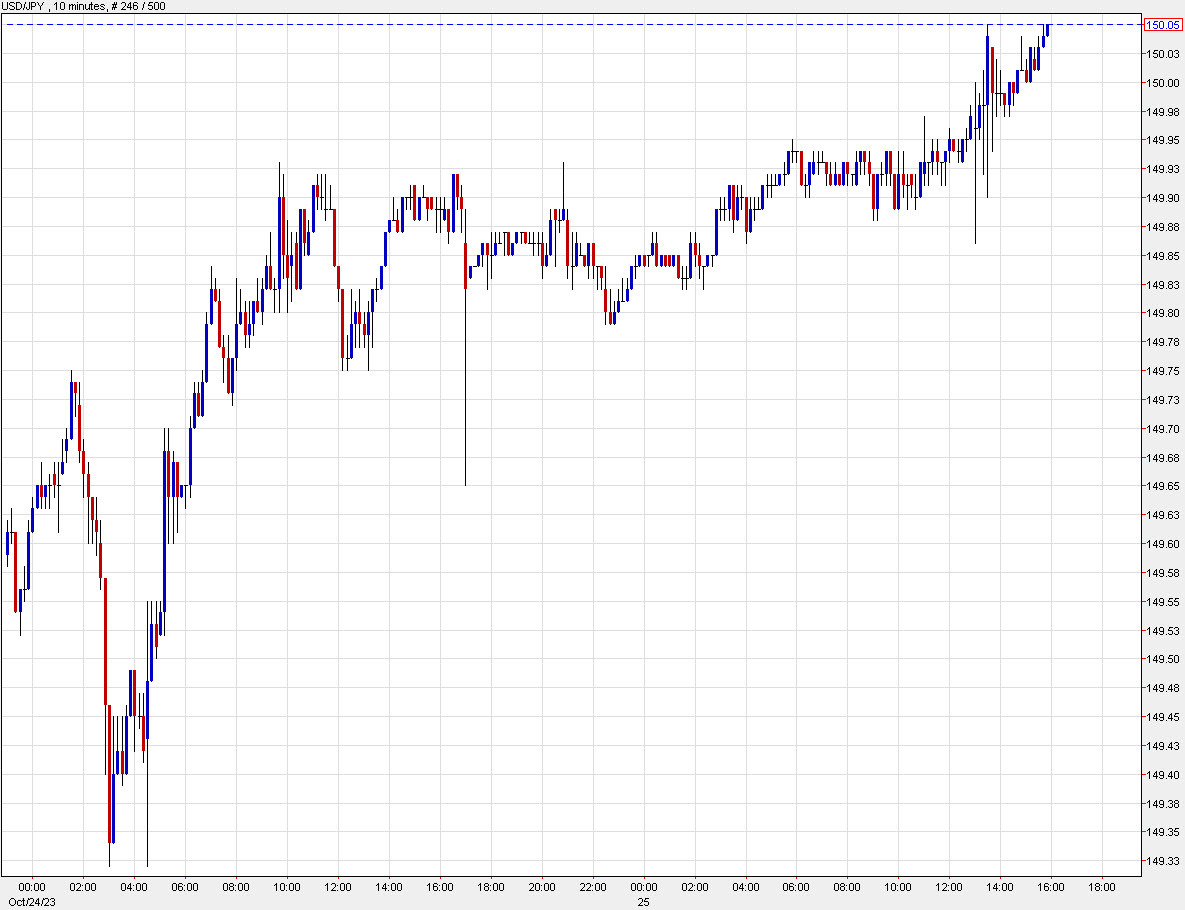

It's tough to hold back the tide when US 10-year rates are up 10 bps today and threatening 5% again.

The last time, the MOF busted this pair all the way down to 147.27 on intervention (though they denied it). Let's see how this episode goes.

It's tough to hold back the tide when US 10-year rates are up 10 bps today and threatening 5% again.

The last time, the MOF busted this pair all the way down to 147.27 on intervention (though they denied it). Let's see how this episode goes.

Most Popular

Corn futures dip 2 cents as cash prices fall. Private export sales to Colombia & Taiwan offer support, but traders eye ethanol production.

Lean hog futures steady to higher; national base hog price $85.13 (+4.94). Coffee, cocoa sink; grains show life.

S&P 500, Dow, Nasdaq rally 1.2% as Trump backs off Greenland tariffs, easing global economic fears.

Santos hits $1.8B FCF, Barossa LNG online! Pikka Phase 1 at 98%. Low breakeven below $30/bbl.

China exported about 5,100 tonnes of silver in 2025, a 16-year high, easing fears that tighter export controls would curb supply. Analysts say most shipments remain unaffected and reflect expanded refining capacity.

Australia's jobless rate drops to 4.1%, boosting RBA hike bets to 60% as Aussie jumps 1.8%.

Bridgewater said it remains moderately optimistic on Chinese equities after its onshore All Weather Plus fund gained about 45% in 2025, far outperforming the CSI 300, citing policy support and improved profit expectations.