Japanese officials won't like the continued weakening of the yen.

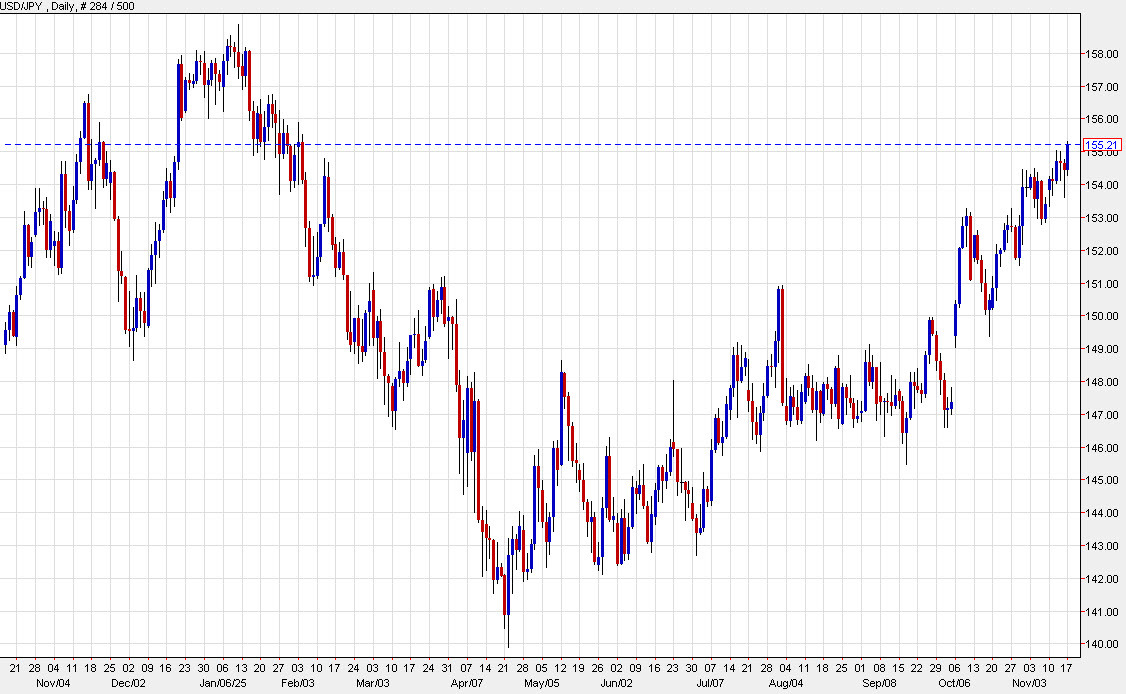

There were buy stops in the past few minutes as it cracked 155.00 for the first time since February and the momentum has continued to 155.25.

On Friday, the pair dipped on risk aversion only to completely recover alongside stock markets. Today, it's also stocks driving the move as the rally coincided with a bounce in stock markets. Note though that US stocks are back to flat on the day in choppy trade.

Last week, Credit Agricole said to expect verbal intervention on a break of 155.00. The thing about that is that few in the market are worried about auction intervention, as it's not even on the radar until +160.

Zooming out to the daily chart, it looks like there is some space to continue the momentum to the January highs near 158.00. The story of the year in all markets this year was early-2025 angst about tariffs and late-2025 relief.