The US stock market is off and running. After premarket trading had the NASDAQ trading down around 140 points, there has been a modest rebound from the get-go. Nevertheless the major indices are still down around -0.7% to -0.9%. It's just not as bad.

A snapshot of the market currently shows:

- Dow industrial average -232 points -0.71% at 32685

- S&P index -29 points at -0.70% that 4092.90

- NASDAQ index -100 points or -0.81% at 11961

- Russell 2000-13.4 points -0.71% at 1876.64

Of note from a technical perspective, the major indices closed above their short term 200 hour moving averages over the last few days. But have retraced back toward those moving averages in trading today.

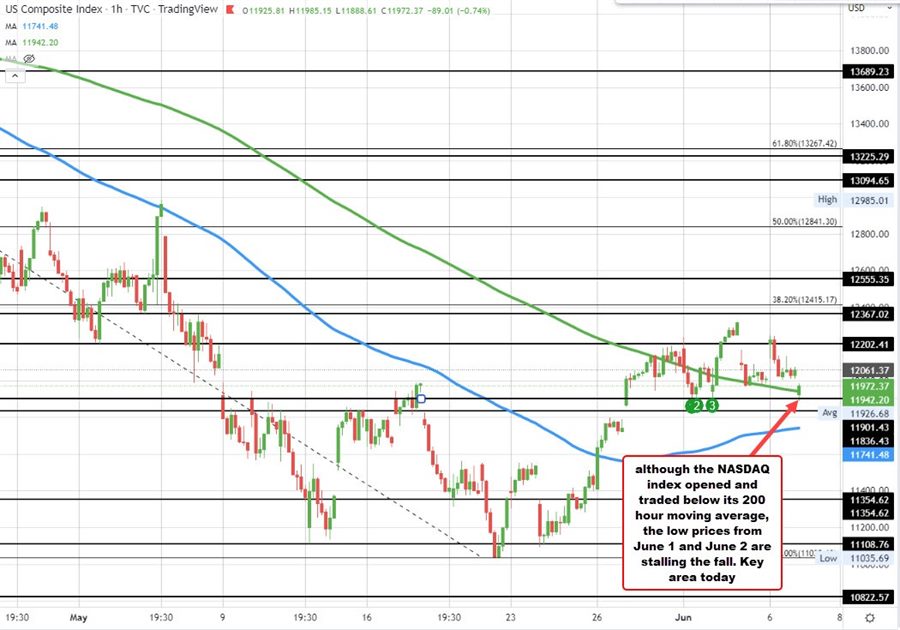

The NASDAQ index has seen a dip below the 200 hour moving average (green line in the chart below) but with the early buying has moved back above the level. The 200 hour moving average on that chart currently comes in at 11942.25. The low price today stalled near swing lows from June 1 and June 2 and bounced. Watch that area between the 200 hour moving average and the swing lows from June 1 and June 2 for bias clues. Move below each would open the door for more selling

For the S&P index, it's 200 hour moving average comes in at 4067.45. With the price currently at 4092, it still has some room.

The 200 hour moving average on the Dow is at 32548.74. At 32685, the index is still 137 points away from the moving average level.

The large retailer Target is down as they now have excess inventories that they have to mark-down to get rid of. There stock is down $8.07 or -5.05% at $151.69.

Target expects the 2nd half of the year to see a rebound in prices which may be good for them but bad for the consumer (especially the low to middle income families) who are seeing their real wages decline as a result of inflation as result of the supply chain issues (higher oil prices) that companies like Target have had.

If Target is intent on raising prices back up, inflation becomes more entrenched, and the supply chain problem - which was supposed to be transitory on inflation - is not but more entrenched. -