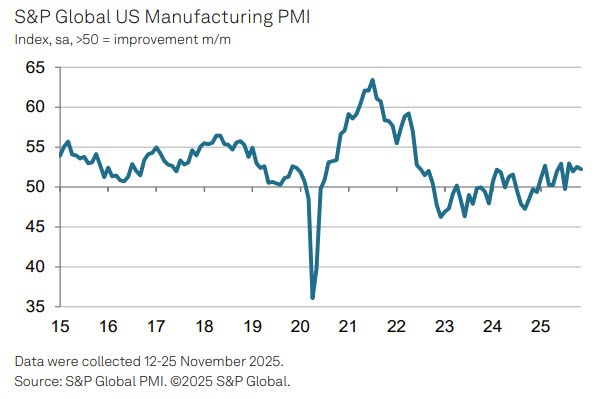

- Prior month 51.9

Details from S&P Global:

Operating conditions improved for the fourth straight month in November, supported by a solid rise in production and further job gains.

Overall performance was held back by a sharp slowdown in demand growth, driven by weaker sales.

Weak demand caused an unprecedented second straight monthly surge in finished-goods inventories, the largest rise in the survey’s 18-year history.

Inflation pressures remained historically elevated, with tariffs frequently cited for pushing input costs higher.

Manufacturers passed along less of the cost increase, resulting in one of the lowest selling-price inflation readings of the year amid intense competition and soft demand.

The headline S&P Global US Manufacturing PMI registered 52.2, down from 52.5, signaling continued—but slower—expansion.

Output rose at the fastest pace since August, supported by gains in both new and existing client orders.

Despite the uptick in orders, overall demand was only modest and slower than October due to ongoing uncertainty.

Export demand remained a drag, with new export orders falling for the fifth consecutive month—the steepest drop since July—linked to tariffs and weaker demand from neighboring and Asian markets.

Sales fell short of expectations for some firms, leading to unintended stockpiling as production outpaced orders.

Business confidence jumped to its highest level since June, driven by plans for new products, higher investment, and expectations of stronger government spending after the federal shutdown ended.

Firms added staff to fill vacancies and in anticipation of rising production and sales; employment growth was the strongest in three months.

Backlogs of work fell modestly for the third month in a row, indicating firms kept ahead of workloads.

After stockpiling earlier in the year, firms were cautious with purchasing; input buying rose only marginally.

Supplier delivery times worsened for a third consecutive month, with logistical delays at tariff-affected borders cited.

Tariffs continued to fuel elevated input-price inflation, especially in metals, while selling-price inflation—though still marked—eased to one of its lowest levels this year.

The more important ISM Manufacturing PMI for November will be released at the top of the hour with expectations of 49.0 versus 48.7 last month. The price is paid index is expected at 57.0 versus 58.0. The employment index came in at 46.0 last month while the new orders were at 49.4 last month