- PCE core m/m +0.5% vs +0.5% expected

- Prior m/m +0.6%

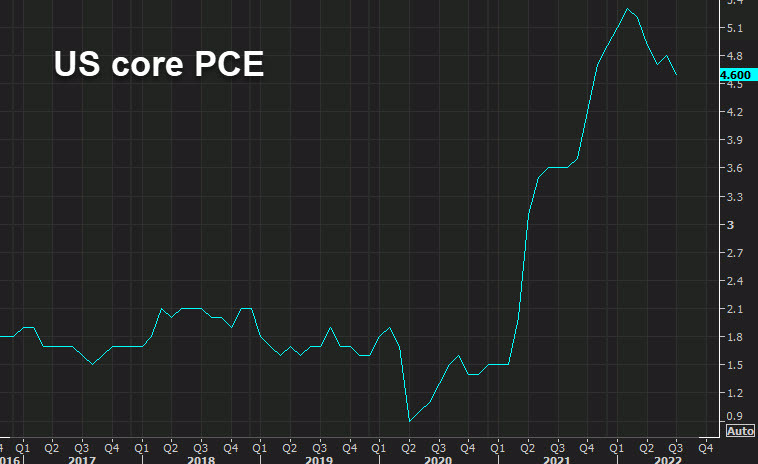

- Core PCE y/y +5.1% y/y vs +5.2% expected

- Prior was 4.9% y/y

- Headline PCE 6.2% y/y vs +6.2% prior

- Deflator m/m +0.3% vs +0.3% prior

- Full report

Consumer spending and income for August:

- Personal income +0.4% vs +0.3% expected. Prior month +0.3%

- Personal spending +0.3% vs +0.4% prior

- Real personal spending +0.6% vs +0.4% expected. Prior month +0.4%

The market is encouraged by this data as equity futures pare losses and yields come down from the highs. It's generally in line with estimates but there have been so many hot readings that the market was likely leaned against a surprise.