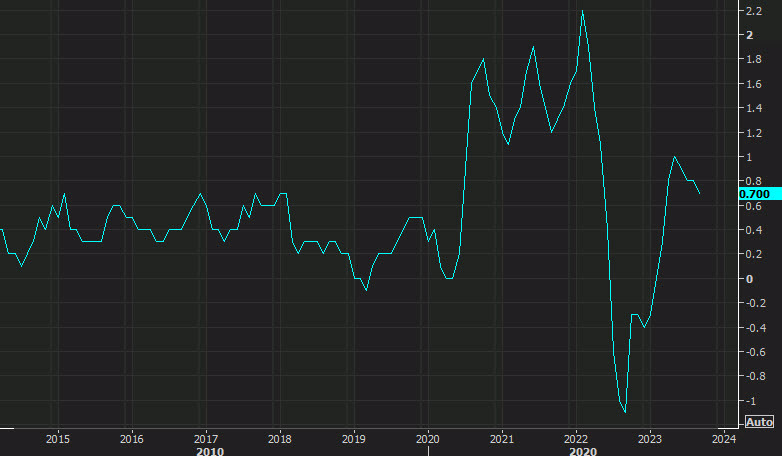

- Prior was +1.0% (revised to +0.8%)

- Prices +3.9% y/y vs +4.0% expected

- Prior was +2.2% y/y

The US housing market has held up much better than elsewhere but there is some downward pressure from high rates.

The US housing market has held up much better than elsewhere but there is some downward pressure from high rates.

Most Popular

Used EVs are cheaper! Price gap narrows to $1,376 vs gas cars. Sales up 21% YoY.

HLT's 26.2% ROE & 33.7x P/E signal caution. F's high debt & flat sales raise risk. NDAQ's 16.1% growth & 15.7% ROE shine.

Binance faces DOJ probe over Iran sanctions; $2B in flows to sanctioned entities questioned.

Stryker shares dip 3% on suspected Iran-linked cyberattack; systems wiped, raising security concerns.

STRC's record 3.6M shares fueled 2,038 BTC buys, outperforming gold & stocks. Institutions are buying.

AOS, GD, UNFI face slow growth & lagging EPS. AOS trades at 17.6x P/E, GD at 22.3x, UNFI at 14x.

Financials lag S&P 500 (-11.5% vs +3.1%). TPG (14.3x P/E), GS (14.1x P/E), LC (8.5x P/E) show growth.

Must Read