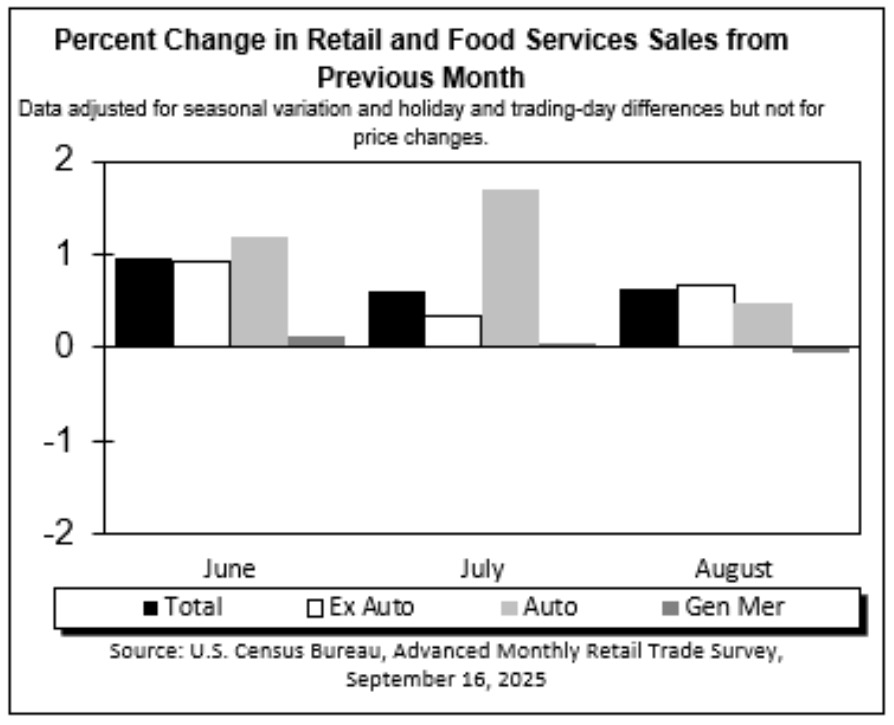

- Prior month 0.5% revised to 0.6%

- Retail sales 0.6% versus 0.2% expected.

- Retail sales ex-autos 0.7% vs 0.4% estimate. Last month revised from 0.3% to 0.4%.

- Retail sales control group 0.7% versus 0.4% estimate

- retail sales ex gas/autos 0.7% versus 0.3% last month (revised higher from 0.2%)

The control group moved up by 0.7% and feeds directly into GDP. The rise should give a boost for GDP models. The Atlanta Fed GDPNow growth estimate was at a healthy 3.1% on September 11. It is scheduled to be revised today.

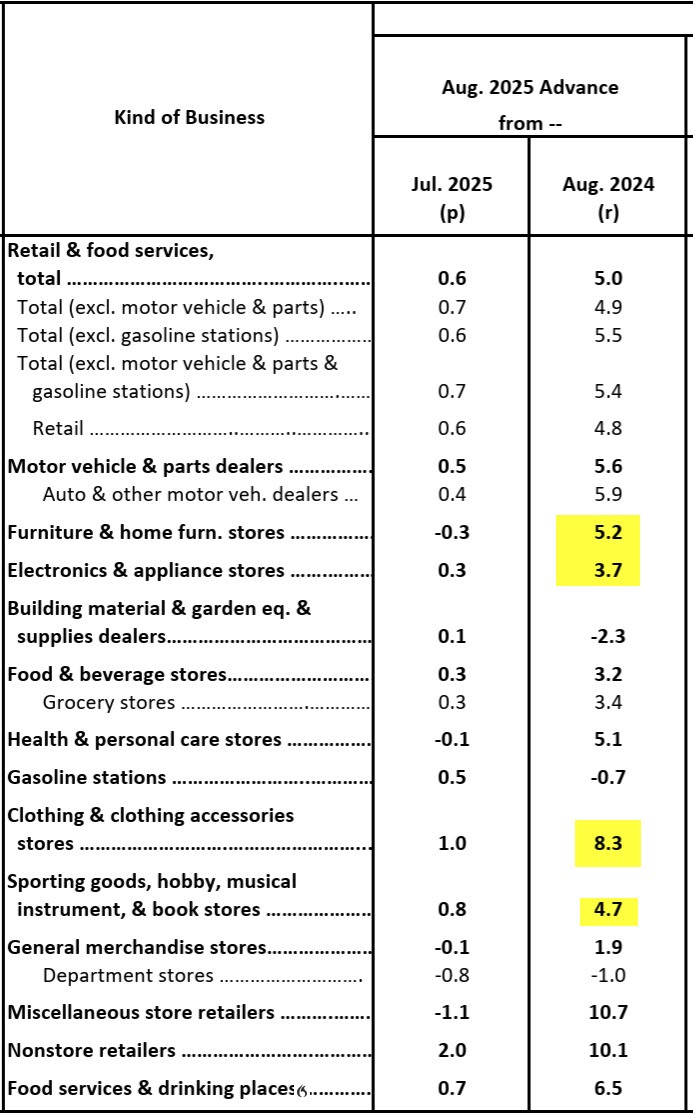

Of note, is that the retail sales may have been boosted by higher prices from imports. Clothing and clothing accessories increased 1%. sporting goods, hobby, musical instruments and bookstores increase by 0.8%, motor vehicle imports dealers increase by 0.5%.

The retail sales will likely not impact the FOMC rate decision. Although it might create a healthy discussion at the FOMC rate decision meeting with dissenters from last meeting Bowman and Waller, being joined by new Fed Governor Miran likely jockeying for a 50 basis point cut. Will other Fed governors be swayed in their direction? Last month the tally was 9 for unchanged policy and 2 for a 25 basis point cut. Absent from that vote was Adrian Kugler (replaced by Miran).

The Fed will also release the expectations of for rates going forward. Of note will be the end of 2025 forecast. Does the Fed see another or to cuts (assuming they will cut by 25 basis points) at the 2 remaining meetings? How do they see rates moving in 2026?