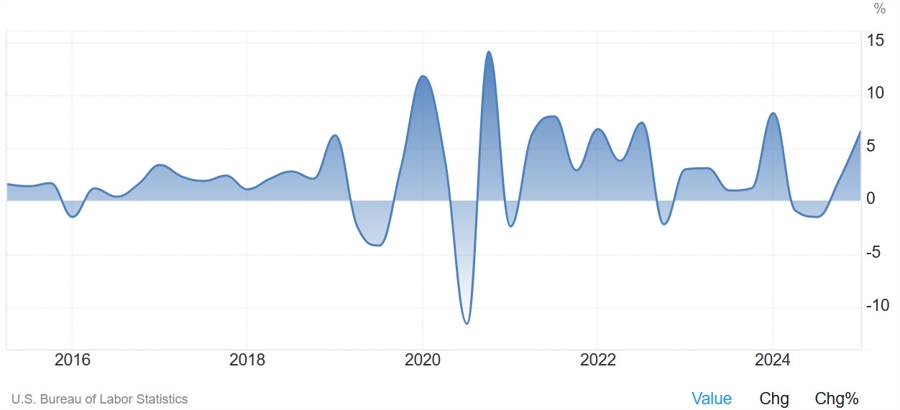

- Prelim was +5.7% vs +2.0% prior

- Productivity -1.5% vs -0.8% prelim

- Prior productivity +1.7%

On face value, there's some inflationary pressure here with labour costs higher and productivity lower but it's volatile and lagging data.

On face value, there's some inflationary pressure here with labour costs higher and productivity lower but it's volatile and lagging data.

Most Popular

BLK shares dip as private credit fund limits redemptions amid outflows. Risk rises, valuation questioned.

GOOGL & NVDA lead AI race. Investors eye 10-yr returns, weighing growth vs. current valuations.

Crude tops $90 as Iran war fears spike oil prices. Energy stocks surge on rising valuations.

GM's new ZR1 boasts 1,064 HP, 2.3s 0-60, hitting 233 MPH. Priced at $185K, it rivals Porsches but undercuts McLarens.

Jobs dip, gas prices climb, and 53% say Trump's economy is worse. Midterms loom.

Nvidia's AI chip boom fuels 200% YTD gains, but P/E ratio nears 80. Is it a buy?

401(k)s gained 66% in 10 yrs, but raiding them for a home risks future returns & incurs penalties.

Must Read