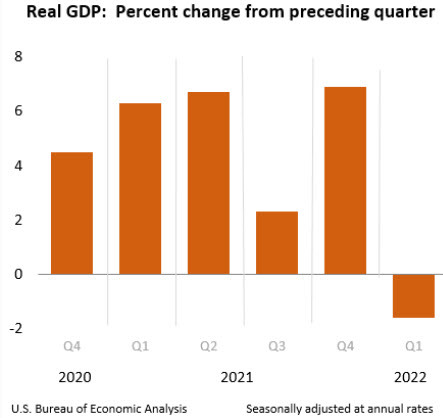

- The second reading was -1.5%

- Core PCE prices final +5.2% vs +5.1% expected

- PCE prices final 7.1% vs 7.0% 2nd reading

- Deflator 8.3% vs 8.1% expected

- Final sales -1.2% vs -0.5% expected

- Consumer spending final +1.8% vs +3.1% 2nd reading

- Inventory change +188.5 vs +149.6B 2nd reading

Percentage point contributions:

- Inventories cut 0.35 pp from GDP compared to -1.09 pp in 2nd reading

- Net trade cut 3.23 pp vs 3.23 pp in 2nd reading

- Personal consumption added 1.24 pp vs +2.09 pp in 2nd reading

- Gross private domestic investment +0.93 vs +0.10 pp in 2nd reading

- Government spending -0.51 vs -0.47 pp in 2nd reading

The negative revisions in spending and higher revisions in inflation both should have made for a larger negative revision overall. That was offset by upward revisions to inventories.

Overall, that inventory build will pull growth away from Q2 and beyond, so we're seeing a negative reaction in the broader markets. In the longer run, higher business investment could also translate into better productivity and output. The main beneficiary to revisions was in equipment investment.