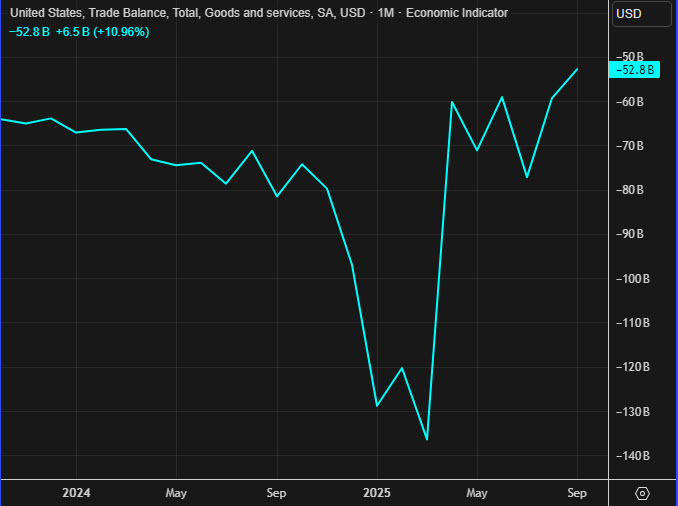

- Prior was a deficit of $52.8B (revised to -48.1B)

- Goods trade balance -58.57B vs -77.69B prior

You will see some big Q3 GDP forecast upgrades with this data. This is the payback from the front-run early in the year and it came in stronger than economists forecast. That led to about a 10 pip rise in USD/JPY as the market looks beyond the gyrations of 2025 and tries to assess the path of the economy in 2026.

We also got the Q3 US productivity report and it was a big beat with productivity up 4.9% compared to 3.0% expected. The prior quarter was also revised to 4.1% from 2.4%. Unit labor costs fell 1.9% compared to +1.0% expected.

Productivity is particularly tough to measure but this is undoubtedly good news and -- if sustained -- it would argue for lower rates even in an accelerating economy. AI is likely only a fraction of this gain but the promise of AI is that we could consistently see numbers like this. The problem is that it might come from layoffs and eventually you need consumers to have money in a consumer-driven economy.

Canadian trade balance for October:

- Balance -0.58B vs -1.36B expected

- Exports 65.61B vs 64.23B prior

- Imports 66.19B vs 64.08B prior

- Exports +3.4%

- Imports +2.1%

This is a good sign for Canadian trade despite the uncertainty around the USMCA agreement. A big tailwind for Canadian trade in 2025 was gold exports and they rose 2.1% in October after a 6.7% rise in September. That's helped to offset falling oil exports due to dropping oil prices.

Manufacturing also got some good news as exports of motor vehicles and parts rose 4.1% in October.

Canada's trade surplus with the United States narrowed from $8.4 billion in September to $4.8 billion in October.

These numbers were all badly delayed by the US government shutdown.