- Prior was +2.7%

- PPI M/M +0.2% vs 0.2% expected

- Prior +0.3%

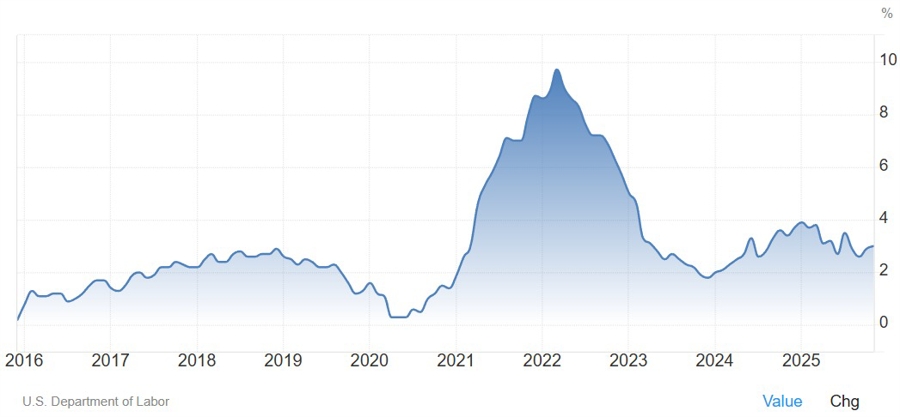

- Core PPI Y/Y +3.0% vs +2.7% expected

- Prior +2.6%

- Core PPI M/M +0.0% vs +0.2% expected

- Prior +0.1%

The BLS notes that the November increase in prices for final demand can be traced to a 0.9-percent advance in the index for final demand goods. Prices for final demand services were unchanged.

As a reminder, this is November data and besides being old news at this point, it could have the same shutdown related issues of the November CPI. I don't expect the market to focus too much on the data because we already got the more important and more timely December CPI yesterday.

The market is pricing 54 bps of easing by year and that's unlikely to change much with today's data. The recent Fedspeak has shown zero interest for a rate cut in January even though the market still assigns it a 9% probability. The Fed projected just one cut in 2026 at the last policy meeting and we will need more labour market deterioration or bigger than expected fall in inflation to see them going faster on rate cuts.

We've seen minimal reaction to the data as expected.

WHAT THE US PPI MEASURES?

The Producer Price Index (PPI) is an economic indicator that measures the average change over time in the selling prices received by domestic producers for their output. In simpler terms, it tracks inflation from the perspective of the seller/business rather than the consumer like the Consumer Price Index (CPI).