As a reminder, we are moving back to the regular scheduled programming in which the US non-farm payrolls data is released on the first real Friday of the month. The November report was plagued by data quality issues amid the longest US government shutdown, which eventually saw the report delayed to the middle of December.

So as we look towards the December report tomorrow, what are some things to watch out for?

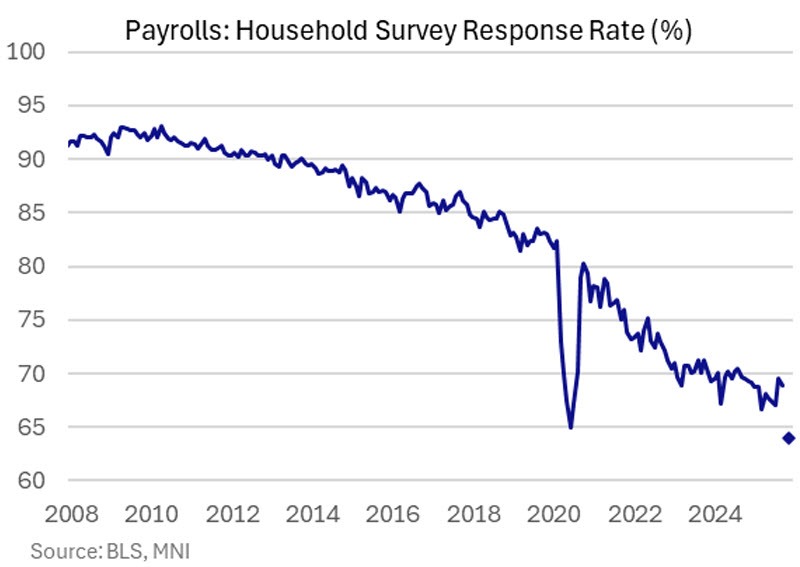

For one, keep a close watch on the household survey response rate. This is one that's already following a declining trend over the last two decades but the November report featured a sharp decline to the lowest response rate on record. The 64% reading is a steep drop from the 68.9% recorded in September (remember, the October report was skipped).

The BLS pointed to this and composite weighting changes in arguing that the "national unemployment rate standard error was going to be larger than usual by a factor of 1.06" just a day before the November report.

Given that things should be "back to normal" this time around, we should see an improvement in the household survey response rate as well as any other technical issues from the prior report. However, it is worth keeping an eye out just in case these complications continue to appear in the December report.

Besides that, there are some other things to watch out for in potentially affecting the employment picture. JP Morgan notes that:

"Despite the government shutdown ending partway through the household survey reference week, a number of federal employees still classified themselves as being on temporary layoff. Reversing that in December could cut the unemployment rate about 4bp."

So, that is another thing to be aware of as the unemployment rate will come under heavy scrutiny after the jump to 4.56% in November. The consensus is for a marginal improvement in the jobless rate in December to 4.5% (rounded) but the broader trend remains clear. And that is unemployment continuing to pick up as the labour market picture softens. So, I would argue that risks are tilted to the higher side here and that is a key risk factor that could impact the Fed outlook; especially if we get a reading closer to 4.7% (rounded).

Then, there's a fresh driver in affecting the December report that should have been absent in November. That being the weather itself. Colder than usual temperatures observed around the payrolls reference period in December could play a small role in impacting the numbers, though this is usually more evident in January and February.

In tying everything together, just be mindful that just because we have seemingly returned to the normal schedule, it doesn't mean that all the kinks have been necessarily ironed out in the numbers just yet.