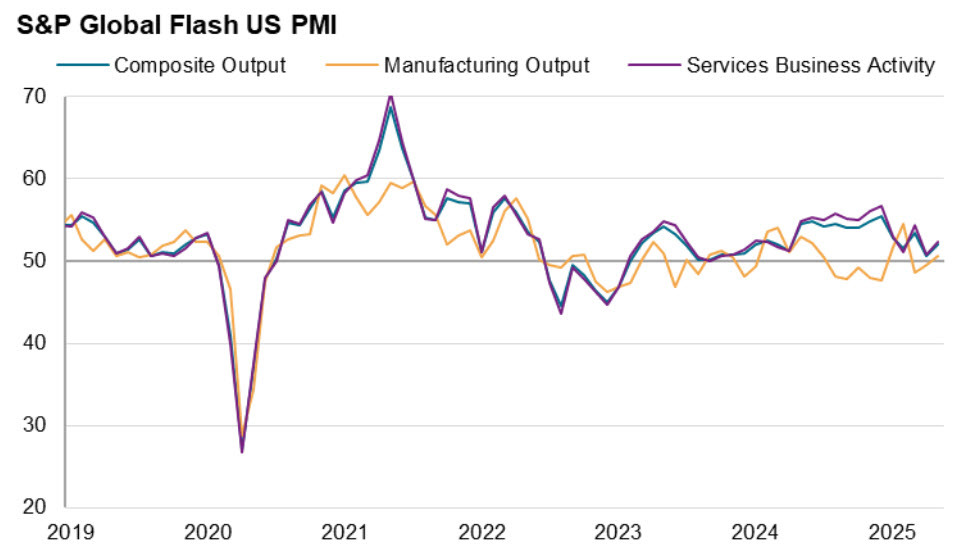

- Prior was 51.4

- Manufacturing 52.3 vs 50.1 expected -- best one-month jump since June 2022

- Prior manufacturing was 50.7

- Composite 52.1 vs 51.2 prior

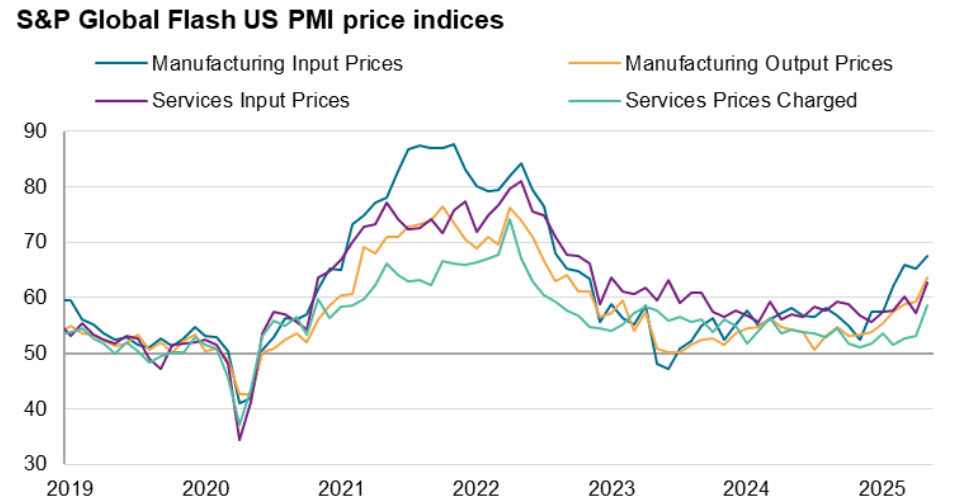

- rise in inventories of purchases was the largest recorded in the 18-year survey history.

This is a nice rebound into solidly positive territory, no doubt due to lower tariffs and a rebound in the stock market.

This is worrisome, though not that surprising.

"Average prices charged for goods and services jumped higher in May, rising at a rate not witnessed since August 2022. An especially steep rise was seen for manufacturers’ selling prices, which posted the largest monthly increase since September 2022. Charges levied for services rose to the greatest extent since April 2023 The latest rise in output prices was overwhelmingly linked to tariffs, having directly driven up the cost of imported inputs or caused suppliers to pass through tariff-related cost increases. Manufacturing input costs rose at the sharpest rate since August 2022 while service sector costs rose at the fastest rate since June 2023"

Here is Chris Williamson, Chief Business Economist at S&P Global Market Intelligence

"Business confidence has improved in May from the worrying slump seen in April, with gloom about prospects for the year ahead lifting somewhat thanks largely to the pause on higher rate tariffs. Current output growth has also picked up from April’s recent low, which had seen the weakest rise for over one-and-a-half years, in response to an upturn in demand.

“However, both sentiment and output growth remain relatively subdued, and at least some of the upturn in May can be linked to companies and their customers seeking to front-run further possible tariff-related issues, most notably the potential for future tariff hikes after the 90-day pause lapses in July. In particular, concerns over tariff-related supply shortages and price rises led to the largest accumulation of input inventories recorded since survey data were first available 18 years ago.

“Supply chain delays are now more prevalent than at any time since the pandemic led to widespread shortages in 2022, and prices charged for both goods and services have spiked higher as firms and their suppliers seek to pass on tariff levies to customers. The overall rise in prices charged for goods and services in May was the steepest since August 2022, which is indicative of consumer price inflation moving sharply higher.”