The White House warned ahead of this report that it expects inflation to be 'extraordinarily elevated'. Let's look at the numbers:

- Prior was 7.9% y/y

- m/m reading 1.2% vs 1.2% expected and 0.8% prior

- Full report

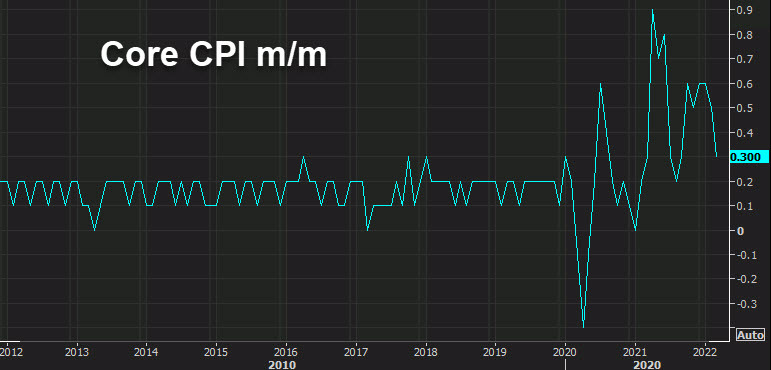

Core CPI:

- y/y 6.5% vs 6.6% expected and 6.4% prior

- m/m 0.3% vs 0.5% expected and 0.5% prior

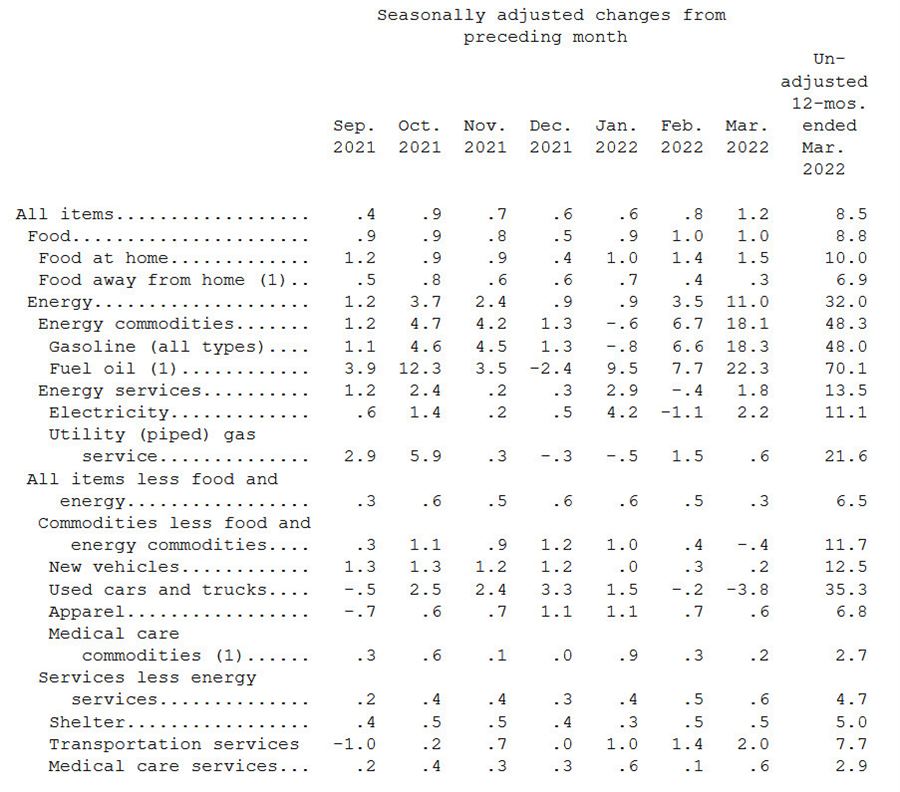

Details:

- CPI energy +11.0%

- Gasoline +18.3%

- New vehicles +0.2%

- Used vehicles -3.8% m/m

- Owners' equivalent rent +0.4%

- Real earnings -1.1% vs -0.4% prior

I think the conversation will start to change on inflation when the month-over-months numbers begin to flatten out. For April (as it stands), there will be large negative pressure from gasoline prices if oil stays near $100. The fall in used vehicle prices will also be a drag on inflation for the foreseeable future. That said, with the lockdowns in China we could be on the cusp of a new round of supply chain shortages.