- Prelim was 53.1

- Prior was 53.7

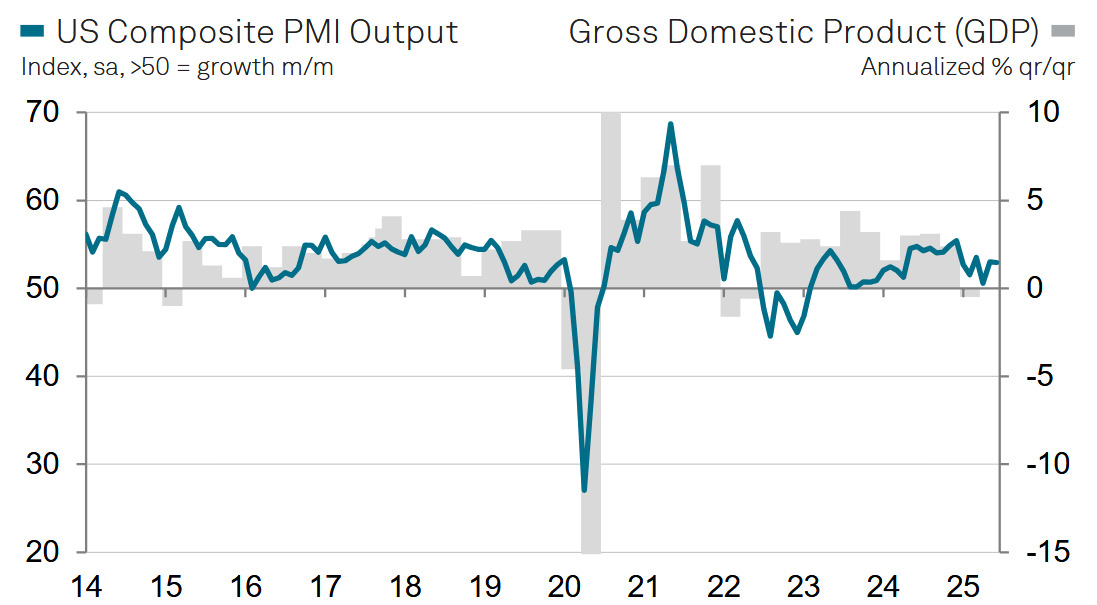

- Composite index 52.9 vs 52.8 prelim

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence

"The US service sector reported a welcome combination of sustained growth and increased hiring in June, but also reported elevated price pressures, all of which could add to pressure on policymakers to remain cautious with regard to any further loosening of monetary policy.

"Viewed alongside an improvement in manufacturing growth reported in June, the services PMI indicates that the economy grew at a reasonable annualized rate approaching 1.5% in the second quarter, with momentum having improved since the lull seen in April. Rising demand for services has meanwhile encouraged firms to take on additional staff at a rate not seen since January.

"We are seeing some worrying signs of weakness below the headline numbers, however, notably in respect to exports and falling activity among consumer-facing service providers, which has curbed the overall pace of economic expansion. Concerns over government policies have meanwhile created uncertainty and dampened spending on services more broadly, while also ensuring confidence in the outlook remains subdued compared to the optimism seen at the start of the year. The continued expansion of business activity in the coming months along the lines seen in June is therefore by no means assured.

"Price pressures have remained elevated in June. Although weak demand and intense competition were reported to have helped moderate the overall rate of increase compared to May, the overall rate of prices charged inflation for services remains the second-highest for over two years, thanks to widely- reported tariff-related cost increases, and will likely contribute to higher consumer price inflation in the near-term."

Market moves were minimal on this but Fed pricing for year-end is 52 bps in easing compared to 62 bps before non-farm payrolls.