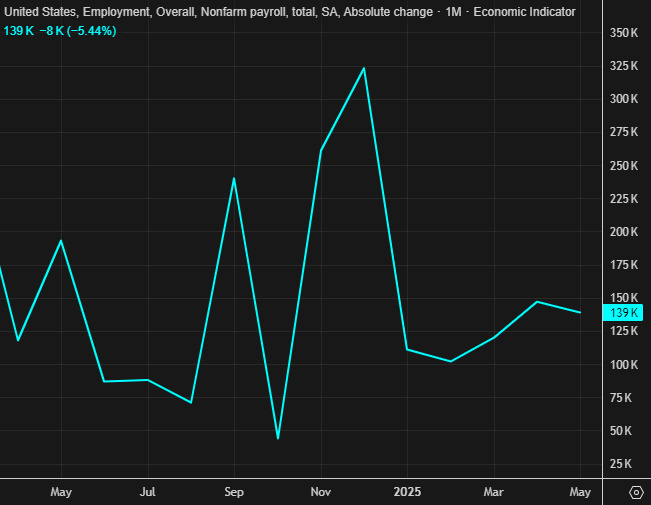

- Prior was +139K (revised to +144K)

- Two-month net revision: +16K versus -95K prior

- Unemployment rate: 4.1% versus 4.3% expected

- Prior unemployment rate: 4.2%

- Unrounded unemployment rate: 4.117% versus 4.244% prior

- Participation rate: 62.3% versus 62.4% prior

- Average hourly earnings (m/m): % versus +0.3% expected and +0.4% prior

- Average hourly earnings (y/y): % versus +3.9% expected and +3.9% prior

- Average weekly hours: 34.2 versus expected and 34.3 prior

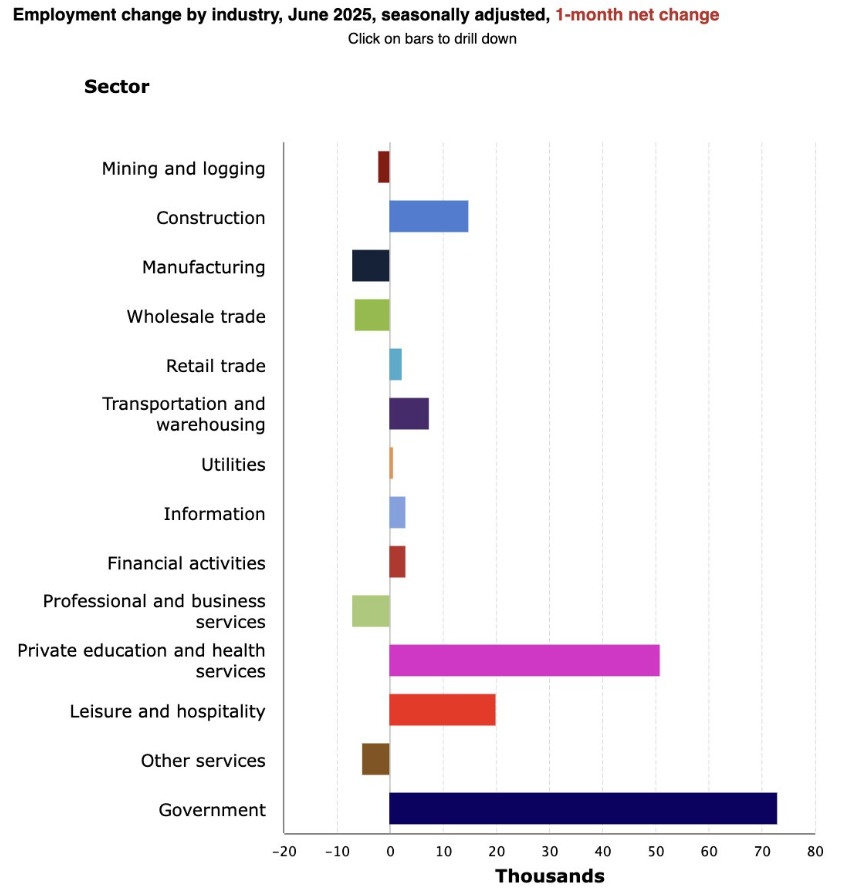

- Change in private payrolls: +74K versus +105K expected and +140K prior -- lowest since Oct 2024

- Change in manufacturing payrolls: +7K versus -5K expected and -5K prior

- Government jobs: +73K versus -1K prior

- Full-time jobs: +437K versus -623K prior

- Part-time jobs: -367K versus K 33K prior

- Household survey +93K vs -696K prior

USD/JPY was trading at 143.87 ahead of the data and shot to 144.97 afterwards as pricing for a July rate cut fell to pretty much nil. September pricing is also down to 20.8 basis points from 30 bps yesterday.

This is a big sigh of relief in markets after a poor ADP jobs reading yesterday.

The US dollar is broadly higher on the data and yields up 3-9 bps led by the front end.

Non-farm payrolls

Here is the breakdown, which shows that the large majority of the jobs were government or government-adjacent (healthcare). State and local hiring was huge and focused on education.

h/t @byHeatherLong