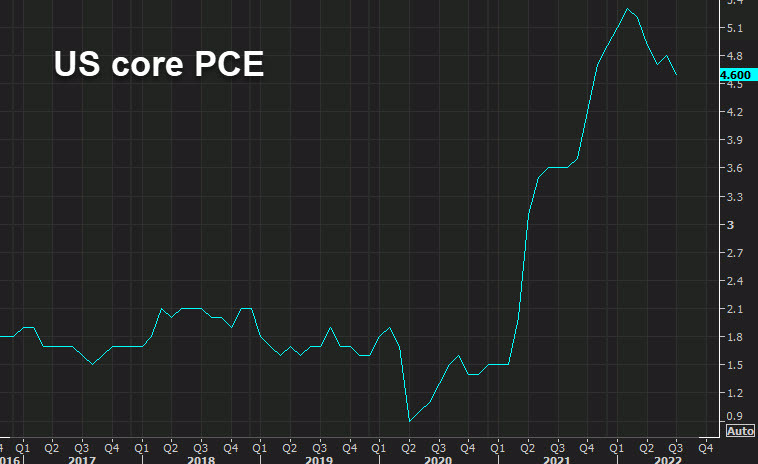

- Prior was +4.8% y/y

- Core m/m +0.1% vs +0.3% expected

- PCE price index -0.1% vs +1.0% prior

- Price index y/y +4.6% vs +6.8% prior

Consumption:

- Personal income +0.2% vs +0.6% exp

- Real personal consumption +0.2% vs -0.4% prior

- Consumption adjusted +0.1% vs +0.4% expected

- Prior consumption +1.1%

Consummption was on the soft side but all the focus is on the misses on core and headline inflation . That's more evidence -- along with CPI -- that prices weren't running as hot in July. There will be more of that in August.

The pricing for 75 bps is too high.