- Prior was 51.8

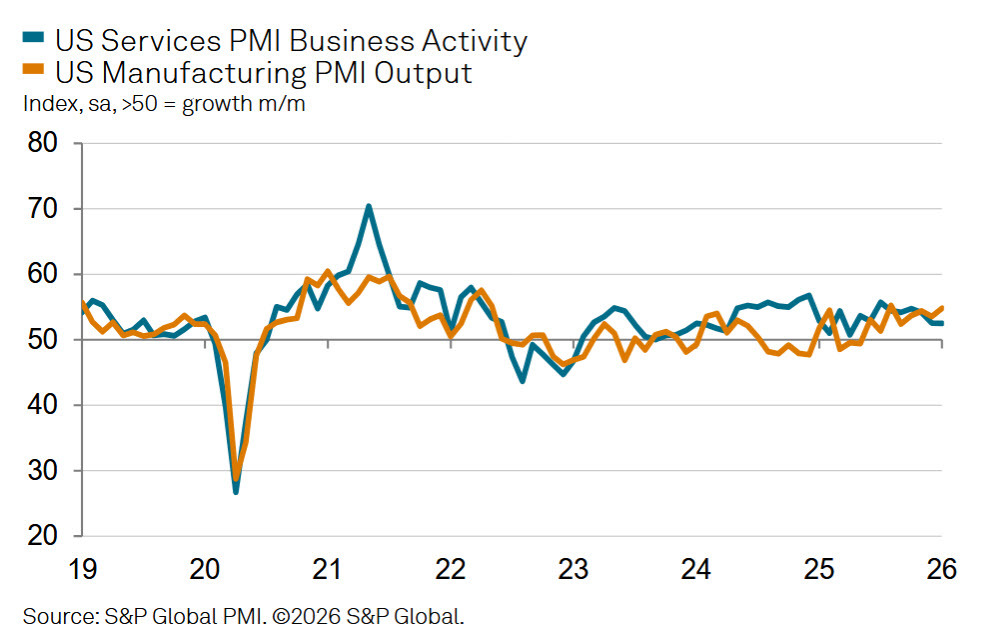

- Manufacturing 51.9 vs 52.20 expected

- Prior manufacturing 51.8

- Composite 52.8 vs 52.7 prior

- Confidence in the year ahead outlook meanwhile remained positive but dipped slightly lower

- Manufacturing price pressures intensified in January, tariffs cited

- New order growth improved from December’s 20-month low

- Export markets were a key source of order book weakness for both manufacturing and services

This numbers are below-consensus but note that both manufacturing and services saw a slight uptick in the month.

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence:

"The flash PMI brought news of sustained economic growth at the start of the year, but there are further signs that the rate of expansion has cooled over the turn of the new year compared to the hotter pace indicated back in the fall.

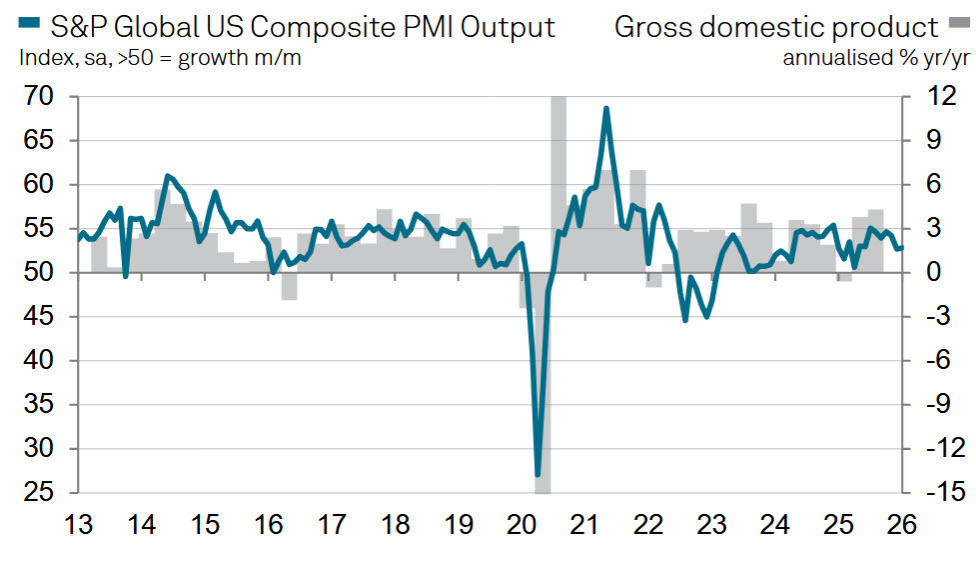

"The survey is signalling annualised GDP growth of 1.5% for both December and January, and a worryingly subdued rate of new business growth across both manufacturing and services adds further to signs that first quarter growth could disappoint.

"Jobs growth is meanwhile already disappointing, with near stagnant payroll numbers reported again in January, as businesses worry about taking on more staff in an environment of uncertainty, weak demand and high costs.

"Increased costs, widely blamed on tariffs, are again cited as a key driver of higher prices for both goods and services in January, meaning inflation and affordability remains a widespread concern among businesses."

There is some real optimism about the US economy at the start of the year but it's not showing up in the survey data, which is often a leading indicator. Businesses are struggling with tariffs and business uncertainty, there is also a drag from anyone on the wrong side of the K-shaped economy, something we've seen from airlines.

The consumer side of the economy is also very tough to get a read on with the UMich sentiment index at compared 56.4 to 54.0 in the prelim reading and 52.9 in December. That's a nice bump but let's put it into perspective.

The inflation index changes might be more meaningful with it at 4.0% compared to 4.2% a month earlier. Longer term inflation expectations ticked up to 3.3% from 3.2%.