- Prior was -8.8

Details:

Employment: +9.7 vs +12.9 last month

Prices paid: +46.9 vs +43.6 last month

New orders: +14.4 vs +5.0 last month

Shipments: vs +3.2 last month

Unfilled orders: vs -6.2 last month

Inventories: vs +6.5 last month

Average workweek: vs +14.7 last month

Six-months from now indicators:

6 month index: vs +41.6 last month

Capex index 6-month forward: vs +30.3 last month

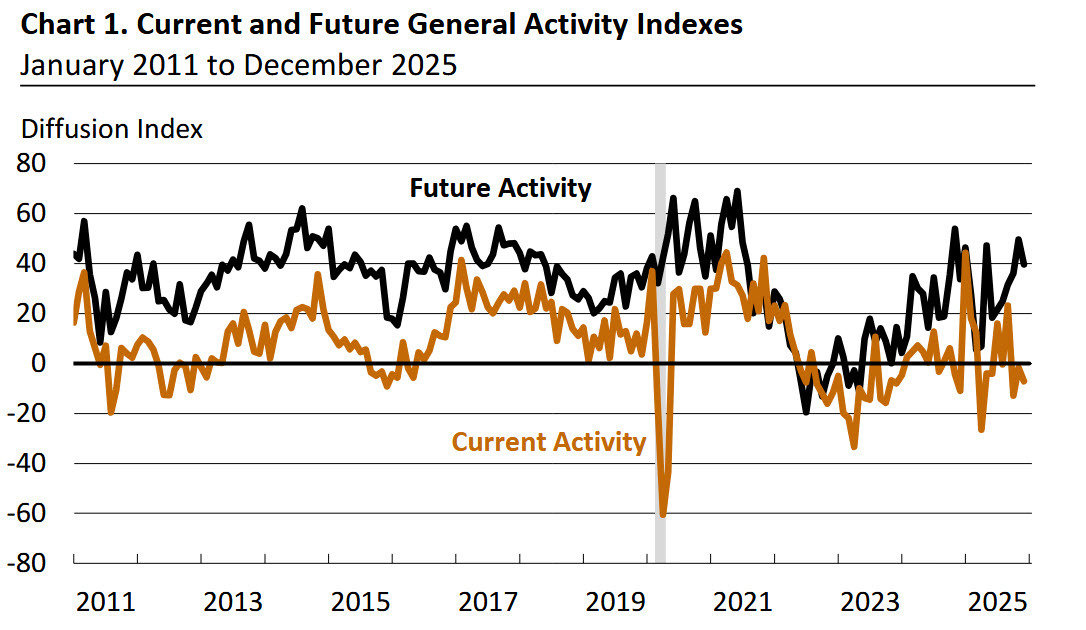

The Philly Fed is a solid look at manufacturing in the region but the entire US manufacturing sector is increasingly irrelevant in terms of national employment, GDP and markets. It represents something of a broader look at overall economic sentiment, so it still has some value but it's rarely an FX market mover or anything else.

Separately, the import/export price indexes were released for November:

- Import prices +0.4% vs -0.1% expected (prior 0.0%)

- Import prices y/y vs +0.3% prior

- Export prices +0.5% vs +0.2% expected (prior was 0.0%)

There is some inflation hidden in these numbers and all of this is coming with oil prices at very low levels.