US January 2026 CPI

- When: Friday, 13 Feb 2026, 1230 GMT / 0830 US Eastern

Summary

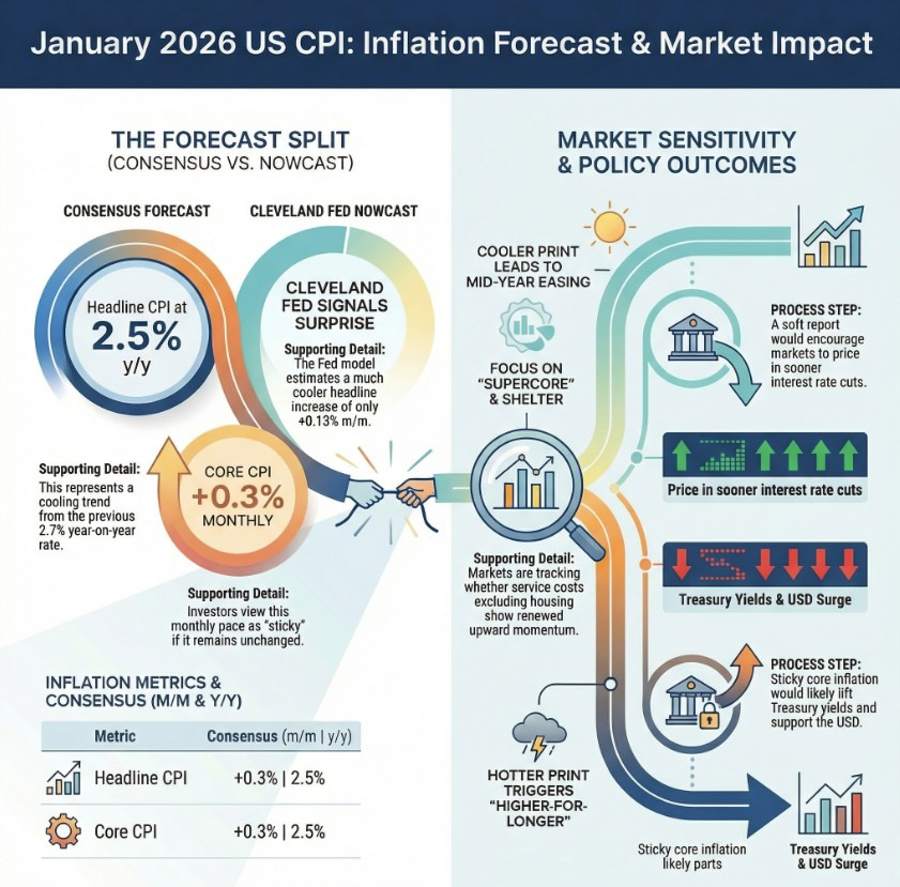

- Consensus: headline CPI seen +0.3% m/m and 2.5% y/y (down from 2.7% y/y).

- Core CPI: seen +0.3% m/m and 2.5% y/y (down from 2.6% y/y).

- Nowcast check: Cleveland Fed model is notably cooler than consensus (about +0.13% m/m headline, +0.22% m/m core).

- Market sensitivity: the print is likely to swing rate-cut timing/pricing, especially via the core services/shelter impulse

The US CPI report for January lands at a sensitive moment for markets, with investors trying to pin down whether the late-2025 inflation re-acceleration is fading or becoming entrenched. The headline CPI rate is expected to cool to around 2.5% year-on-year from 2.7% previously, while core CPI is also seen easing to roughly 2.5% from 2.6%. On a month-on-month basis, economists look for a firmer +0.3% for both headline and core, still a pace that can feel “sticky” if repeated.

Under the hood, markets will focus less on the headline (often driven by energy) and more on whether core disinflation is resuming, particularly in services categories that tend to track wages and rents. A key question is whether shelter-related components continue to cool cleanly, and whether “supercore” style readings (core services ex-shelter, where investors look for persistence) show renewed momentum.

There’s also a notable split between consensus expectations and model-based nowcasts. The Cleveland Fed’s inflation nowcasting estimates imply a much softer headline monthly outcome than the typical +0.3% call, though its core estimate is closer to the sticky narrative. That divergence raises the risk of a “surprise factor” either way—especially if seasonal effects or category-level volatility distort the month-on-month print.

For policy, a cooler core outcome would help markets lean back toward mid-year easing expectations, while a hotter/stickier core print could push cuts further out, lift Treasury yields, and support the USD via a higher-for-longer repricing.