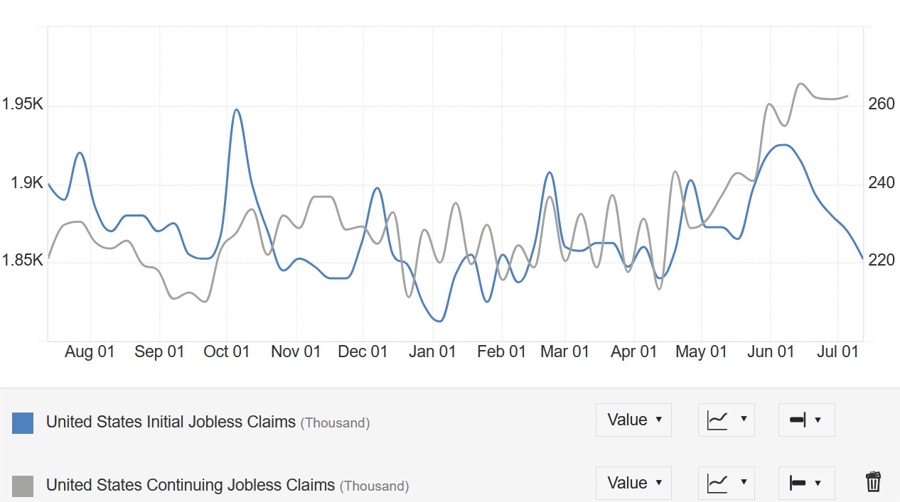

- Prior 227K (revised to 228K)

- Continuing claims 1956K vs 1965K expected

- Prior 1965K (revised to 1954K)

This is still a low firing, low hiring labour market. The data points to resilience and nothing to worry about.

This is still a low firing, low hiring labour market. The data points to resilience and nothing to worry about.

Most Popular

Housing market sees modest 1.8% sales gain, 0.4% price appreciation amid inflation & job fears.

AI & data firms join S&P 500; crude futures overbought since '90, but rally may continue.

Claude surges 55% in downloads post-Pentagon deal snub, topping app charts. ChatGPT faces backlash.

Breakaway offers affordable festival tickets ($40/day) vs. $1550+ for Eras tour, attracting Gen Z with value.

Europe's energy costs surge 3-year high, hitting industry competitiveness & AI growth.

Claude surges 55% in downloads, dethroning ChatGPT amid Pentagon contract controversy. Users shift.

WTI crude jumps 38% on Iran conflict, gas prices surge $0.38/gal. Geopolitical risk trumps US production.

Must Read