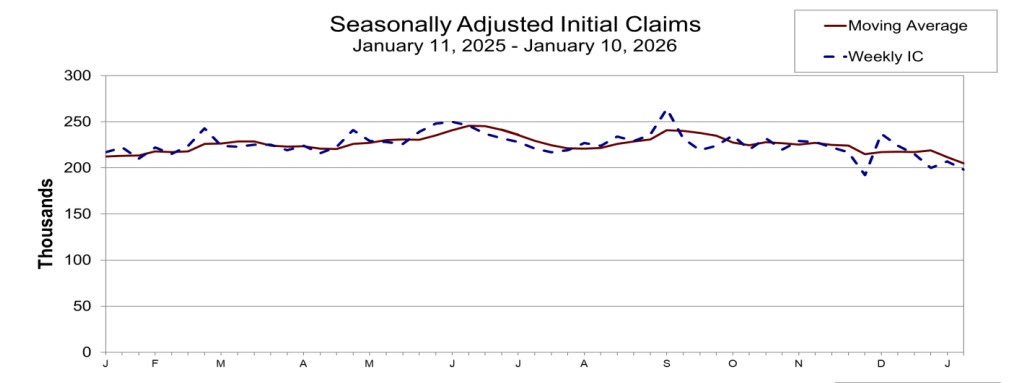

Initial Jobless Claims

Initial claims: 198,000, ↓ 9,000 from the prior week (revised to 207,000)

Prior week revision: ↓ 1,000 (from 208,000 to 207,000)

4-week moving average: 205,000, ↓ 6,500 on the week

Trend signal: Lowest 4-week average since January 20, 2024, highlighting continued labor-market resilience

Continuing Claims

Insured unemployment rate: 1.2%, unchanged

Continuing claims: 1.884 million, ↓ 19,000 from the prior week (revised to 1.903 million)

Prior week revision: ↓ 11,000 (from 1.914 million to 1.903 million)

4-week moving average: 1.889 million, ↓ 250 on the week

Trend signal: Stability with mild improvement, no sign of sustained labor-market deterioration

Market takeaway: Jobless claims remain low and trending lower, reinforcing the view of a resilient U.S. labor market, which limits the urgency for aggressive Fed easing and keeps the USD supported on dips.

There is some chatter that the claims may be impacted by seasonally adjustments.

Looking at the markets, the broader S&P and Nasdaq are higher with the S&P up about 36 points and the Nasdaq up 254 points.

In the US debt market, yields are higher and trading near the high:

- 2 year yield 3.558%, +4.2 basis points

- 5 year yield 3.755%, +4.0 basis points.

- 10 year yield 4.161%, +2.2 basis points.

- 30 year yield 4.766%, +1.0 basis points

Fed's Goolsbee is talking on CNBC and says that we need to get inflation down to 2%. He says there are some things in the recent CPI and PPI data that there are some things are encouraging, but some things that are still disturbing.

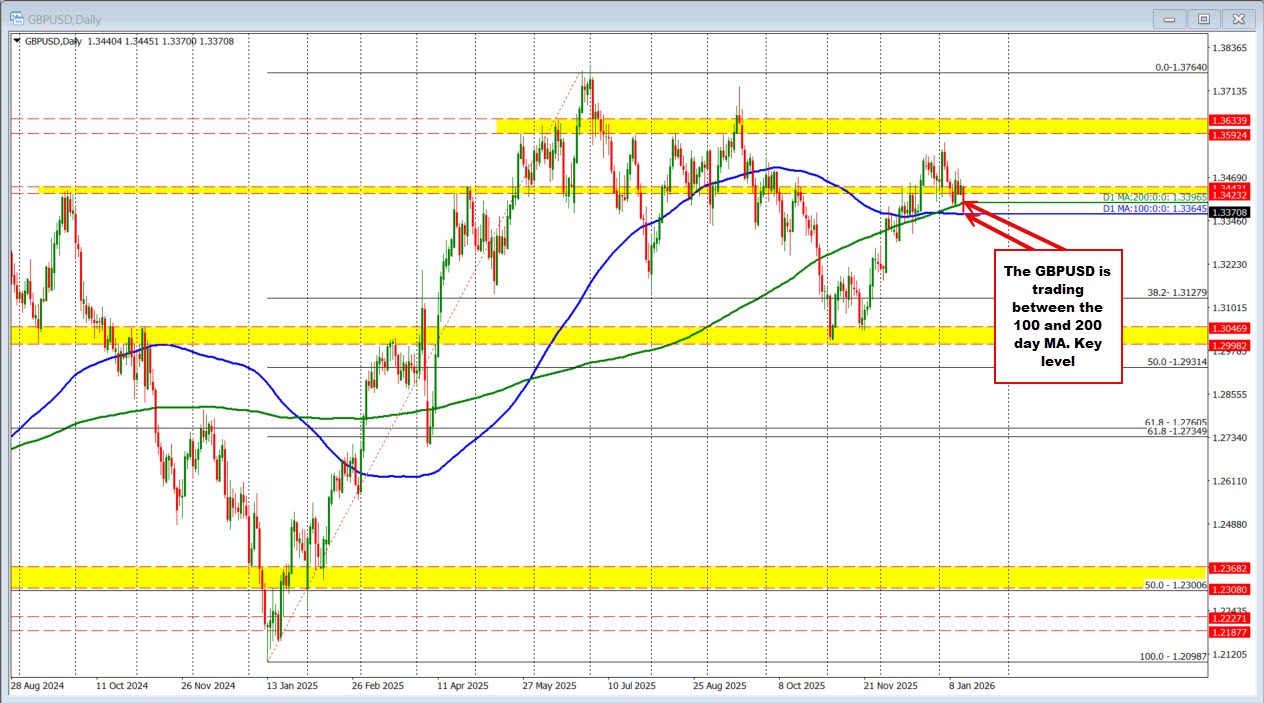

The USD is moving higher as well. Of interest is that the GBPUSD is trading between the 100 and 200 day MAs between 1.33645 and 1.33965. The price has moved below the 200 day MA at 1.33965 but remains above the 100 day MA at 1.33645. The low just reached 1.3373.

Initial jobless claims track the weekly number of Americans filing for unemployment benefits for the first time and are one of the most timely indicators of U.S. labor-market health and overall economic momentum. Rising claims can signal increasing job losses and a slowing economy, while declining claims suggest that hiring is outpacing layoffs, pointing to underlying economic strength. Released every Thursday by the U.S. Department of Labor, the report is closely watched by economists and markets alike, with particular emphasis on the four-week moving average, which helps smooth out weekly volatility and provides a clearer view of underlying labor-market trends.