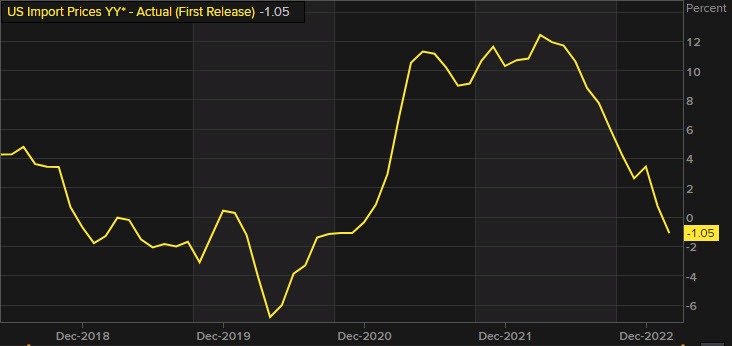

Import prices year on year

- Prior import prices -0.2% revised to -0.4%

- Import prices -0.1% versus -0.2% expected

- import prices year on year-1.1% year on year. This was the first 12 month decline since the index fell -0.3% in December 2020. It was also the largest drop since -1.3% decline in September 2020

- Export prices +0.2% versus vs -0.1% expected. This is the first monthly increase in export prices since June 2022

- Prior export prices 0.8% revised to +0.5%

- export prices year on year-0.8%. This was the first year on year decrease since the index fell -1.0% in November 2020

Details for imports:

- fuel import prices felt -4.9% for the second consecutive month representing the largest monthly drops since September 2022. Fuel prices have not risen on a one month basis since June 2022

- all imports excluding fuel rose 0.4% in February following a 0.2% increase in January

- prices for non-fuel imports advanced 0.2% year on year

- import prices for finished goods increase for each of the major finished goods categories. Consumer goods +0.5% which was the largest monthly advance since December 2021. Capital goods prices rose 0.3% (the largest one month advance since May 2022). Automotive vehicles increased 0.2% after a 0.3% rise last month.

Details for exports:

- the price index for agricultural exports rose 1.0% following declines of -0.9% in January -2.4% in December

- excluding agricultural, nonagricultural export prices rose 0.1% after rising 0.6% in the previous month

- export prices for major finished goods categories were mostly up in February. Capital goods prices rose 0.6% (versus 0.8% in January). Consumer goods rose 0.7% in February following a 1.1% increase the previous month

Lower import prices is good for US inflation

For the full report click here.