The latest CaseShiller housing price index of the 20-largest US cities showed prices up 1.3% year-over-year, just a shade above the +1.2% consensus but a deceleration from the +1.4% y/y reading in September.

On a monthly basis, home prices rose 0.3%, beating the +0.1% consensus. The September reading was revised to +0.2% from +0.1%.

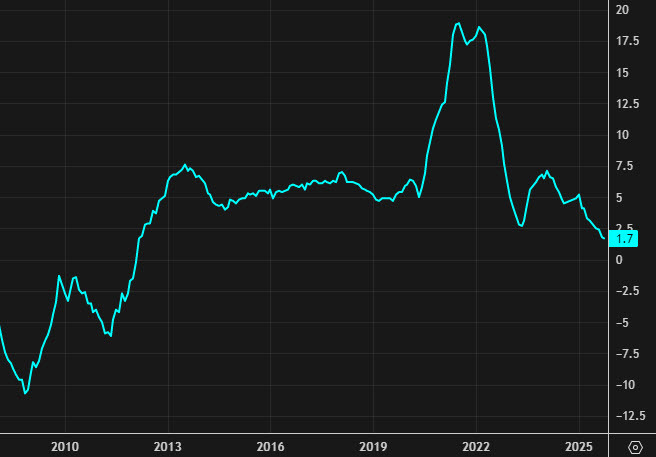

A separate data set from the FHFA painted a similar picture with prices up 1.7% year-over-year nationally. That number was the lowest in 13 years. It's a weak data point to cap off a miserable year for home builders. There is some regional disparity with Mid-Atlantic prices rising 5.3% and lower Midwest prices down 0.7% y/y.

The silver lining is that it improves affordability for home buyers, at least in inflation-adjusted terms. Home affordability is a major and growing political issue.

Trump promised "aggressive' housing reform next year, though few details have leaked.

“There are a lot of things that we can do with regulations to try to help get stuff approved quicker,” said National Economic Council Director Kevin Hassett said on Fox Business. “And we can also do things like reward states that make it easier for people to build a new home.”

At the same time, Trump acknowledge the conflict of improving affordability while preserving home values.

"I don't want to knock those numbers down, because I want them to continue to have a big value for their house. At the same time, I want to make it possible for young people out there and other people to buy housing," he said.

"In other words, you create a lot of housing all of a sudden, and it drives the housing prices down. So I want to take care of the people that have houses that have a value to their house that they never thought possible, that have sort of made them wealthy and happy, and especially in their later years. Got to be careful with that. I want to keep them up. At the same time, I want to make it possible for people to go buy houses," he continued.

That's a tough needle to thread but one thing Trump is sure to do is try to drive down borrowing costs, something he will lean on a new Fed chair to do. He also floated the idea of suing Fed chair Powell on Monday.