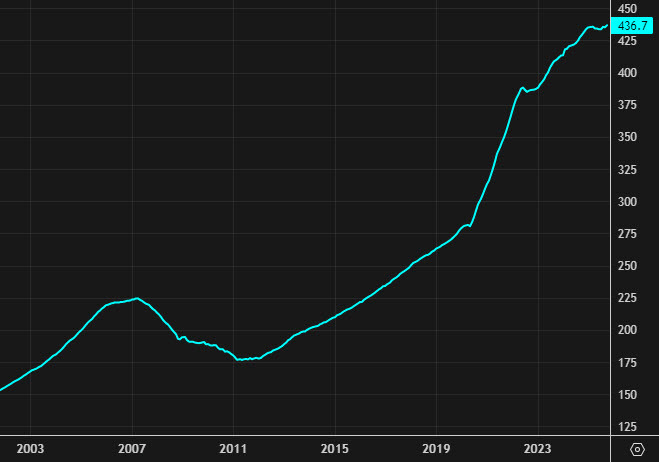

CaseShiller data for the 20-largest metropolitan areas:

- Prior annual price rise 1.3%

- Monthly November price +0.5% vs +0.3% prior

- Non-seasonally adjusted 0.0% vs -0.3%

November national numbers

- Annually 1.9% vs +1.7% prior (revised to +1.8%)

- Monthly +0.6% vs +0.4% prior

- Index 439.3 vs 436.7 prior

Is the US housing market coming to life?

It's take awhile for home buyers to realize that the ultra-low pandemic borrowing rates aren't coming back. Even if the Federal Reserve cuts by another 100 bps, the long end isn't going to move much.

At some point the renters will have to come off the sidelines and take the 30-year mortgages or shift into adjustable-rate mortgages for the time being. There is always going to be an advantage to owning in terms of certainty and home builders are now trimming their outlooks once again.

It's been a miserable few years for the entire sector but it certainly represents an upside risk from here. Trump has floated allowing people to use retirement funds to purchase houses and that could be the jolt that brings the market to life once again. The reports today show there is an appetite to buy and that will be tested as the spring buying seasons begins.

Should housing come alive, it would be a further tailwind for commodities, including beaten up ones like steel and lumber. Housing-focused retailers like Home Depot (HD) and Lowe's (LOW) would also benefit along with the broader consumer sector.

One risk is that much of the gains in the past few years in equity markets and tax cuts has flowed to the upper-end consumer, which already owns housing. In contrast, higher inflation has hit the would-be home buyer hardest.