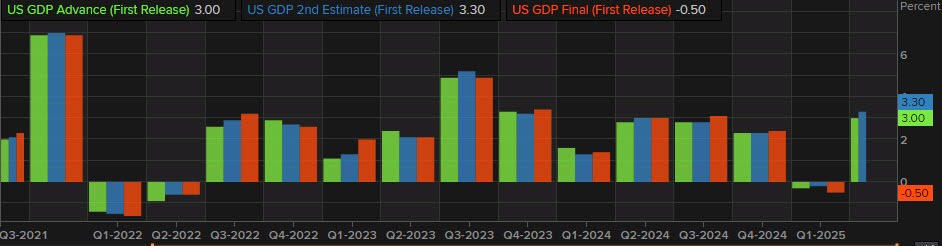

- Prior estimate 3.0%

- GDP 2nd revision 3.3% vs 3.1% estimate

- Sales Preliminary Q2 6.8% vs 6.3% last

- Consumer spending Prel. 1.6% vs 1.4% last

- GDP deflator 2.0% vs 2.0% estimate. Last 2.0%

- Core PCE Prices prelim. 2.5% vs 2.6% est. Last 2.5%

- PCE prices preliminary 2.0% vs 2.1% preliminary

- PCE ex food and energy housing 2.2% versus 2.2% preliminary

- PCE Services ex energy and housing 2.1% vs 2.3%

Contributors to the 3.3% growth:

- Consumer spending +1.07%

- Investment -2.70%

- Government -0.03%

- Net trade +4.95%

How did the 2nd quarter compare to the 1st quarter?

- Consumer spending +0.31%.

- Investment +3.9%.

- Government +0.10%.

- Net trade -4.61%

The declines in the components in the Q1 were gains in Q2 with tariff impact evident. Inventories, a key part of investment showed a gain of 2.59% in the 1st quarter as companies increased imports, while inventories declined -3.29% in the 2nd quarter.

In the 1st quarter imports contributed a negative -4.66% to GDP (imports are a negative contribution to US GDP). In the 2nd quarter imports added 5.09% as the import surge declined.

The data is old news better and quarter data makes the start point for the current quarter a higher level.

US stocks are marginally higher:

- Dow industrial average up 80 points

- S&P up 3.35

- NASDAQ index up 3.15%