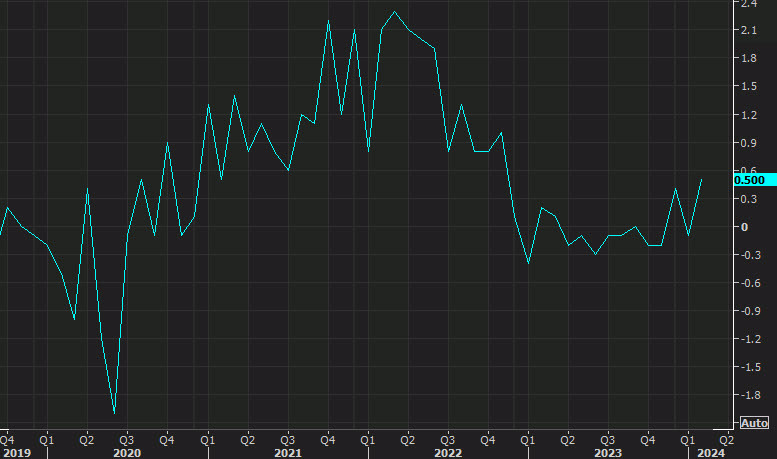

- Prior was -0.3% (revised to -0.2%)

- Retail inventories ex autos +0.4% vs +0.3% prior

- Inventories down 1.6% from February 2023

This is a lower-tier indicator but it feeds into GDP and the read-through is for a hotter Q1.

This is a lower-tier indicator but it feeds into GDP and the read-through is for a hotter Q1.

Most Popular

UK inflation hits 3.4% in Dec, above BoE target. Traders eye rate cuts as economists see temporary blip.

50-yr-olds' 401(k) balances range $188K-$635K. Aim for 5-6x income saved; market swings impact growth.

MMA rates at 4.1% offer 7x national avg. as Fed cuts rates. Last chance for high yields before 2025 cuts.

Fed rate cuts push HYSA yields to 4% APY, but expect further drops. Lock in now for safe, solid returns vs. market volatility.

Mortgage rates jump to 6.05% on geopolitical tension; 15-yr fixed at 5.50%. Traders watch Fed policy.

2026 tax brackets up 2.3%! OBBBA expands deductions, lowering bills. Adjust withholding for more take-home pay.

Tariffs cost Americans 96% of the burden, fueling inflation fears. Supreme Court ruling delayed, leaving policy in limbo.

Must Read