US retail sales

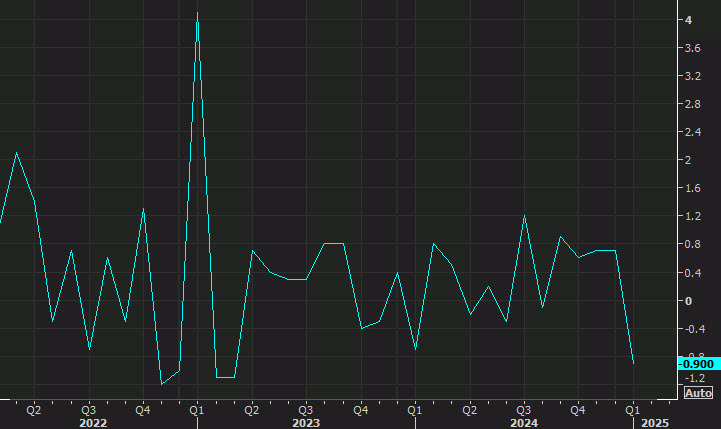

- Prior was -0.9% (revised to -1.2%)

Details:

- Ex-autos +0.3% versus +0.3% expected

- Prior ex-autos -0.4% (revised to -0.6%)

- Control group +1.0% versus +0.3% expected

- Prior control group -0.8% (revised to -1.0%)

- Retail sales ex gas and autos +0.5% vs -0.5% prior (revised to -0.8%)

"Our topline performance for the month was soft," Target CFO Jim Lee said at the start of March. He highlighted poor weather but said that "declining consumer confidence impacted our discretionary assortment overall."

This data shows the consumer more resilient. The control group is the best metric of consumer momentum and it rebounded nicely in February after a weak showing in January. The revisions take some of the shine off it though.

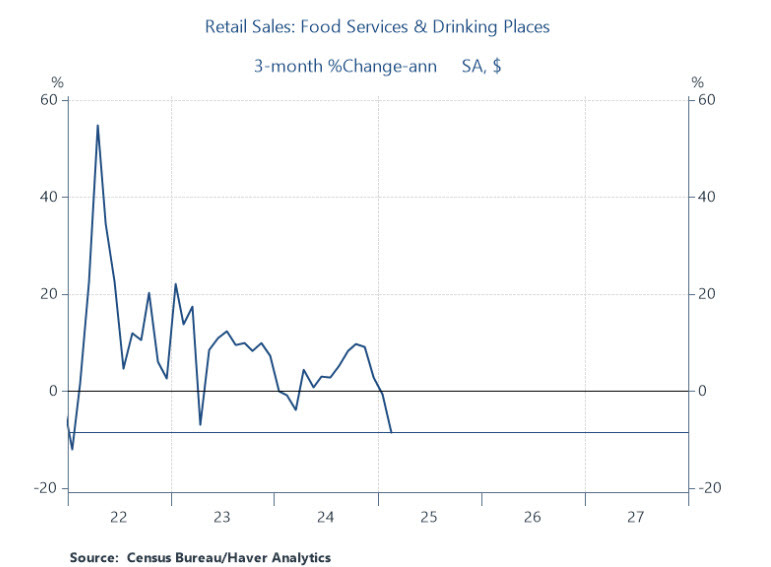

One forward-looking area that showed some softness in the month was food services & drinking places, which declined by 1.5% month-over-month. That could be weather or it could be consumers pulling back, in line with weaker consumer sentiment surveys.

Other notable movers:

- Health & personal care stores: +1.7% (strongest sector growth)

- Motor vehicle dealers: -0.4%

- Food & beverage stores: +0.4%

- Nonstore retailers (e-commerce): +2.4%

- Gasoline stations: -1.0%

- Department stores: -1.7%

- Clothing & clothing accessories stores: -0.6%

That breakdown is a bit more concerning than the control group and we also got a poor Empire reading at the same time. Certainly the US consumer isn't falling off a cliff but this won't wash away concerns. I'll be interested to hear what Powell says about the state of the US consumer.

This is from Renaissance Macro:

Consumers have been cutting back on their discretionary purchases. Over the last three months, restaurant sales have collapsed 8.5% at an annual rate. The consensus miss on retail sales was an online shopping story this month as it was last month. Outside of that, conditions weak.