- Prior quarter was 0.8%

- Employment benefits 0.7% vs 0.8% prior quarter

- Employment wages 0.7% vs 0.8% prior quarter

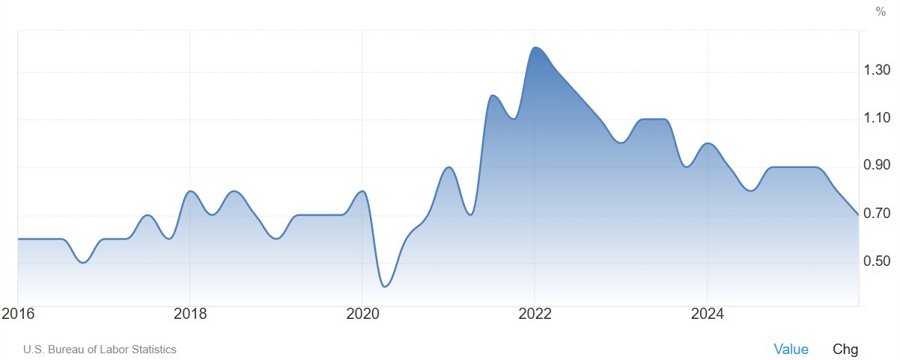

The easing in wage growth supports the rate cutting cycle. Powell has mentioned many times that he doesn't see inflationary pressure coming from wage growth given the easing in labour market conditions. The ECI is now back to pre-pandemic levels.

The US Dollar has weakened across the board on this report and the softer Retail Sales data as the dovish bets increased slightly. The NFP report tomorrow could still give the greenback a boost but it needs to be a strong one.

The Employment Cost Index (ECI) is a quarterly report from the Bureau of Labor Statistics (BLS) that measures the change in the total cost of labor for businesses. The Fed considers the ECI the "gold standard" for measuring wage inflation because it is more precise and comprehensive, the only drawback is that it's not as timely as the Average Hourly Earnings data.