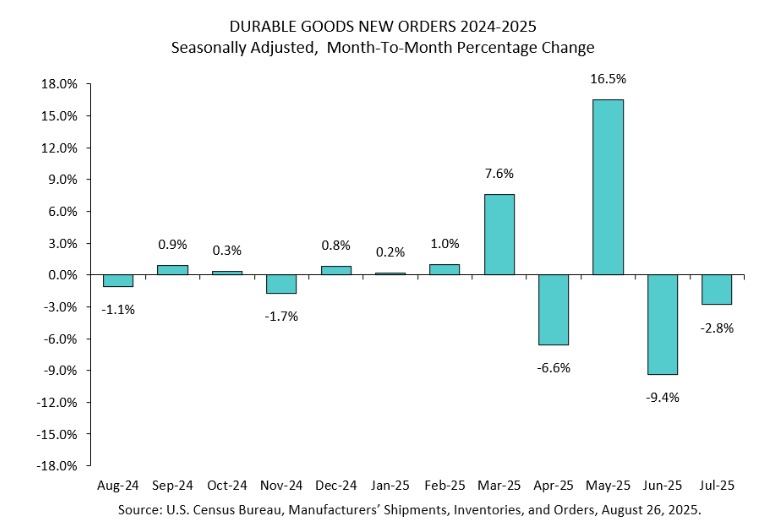

- Prior month -9.4%

- Durable goods for July -2.8% versus -4.0% estimate.

- Durable goods ex transportation +1.1% versus 0.2% expected. Prior month revised to 0.3% from 0.2%.

- Durable goods ex defense month on month -2.5% versus -3.6% expected. Prior month revised to -9.5% from -9.4%

- Nondefense capital ex air rose 1.1% versus 0.2% estimate. Prior month revised higher to -0.6% from -0.8%.

Durable goods has been down for 3 last 4 months

Transportation was a big drag for the current month. If you took out transportation orders increase by 1.1%.

Taking a view from a different tact, if you exclude defense durable goods orders decreased by -2.5% indicating that the fence durable goods orders have increased. This seems to be a strategy from the Trump administration. They want to sell defense especially overseas with the NATO being a big consumer.

Finally, if you look at non-defense capital expenditures ex air, it gives another view.

Non-defense ex-aircraft durable goods orders are widely used as a proxy for business investment in equipment.

Here’s why:

Durable goods (things meant to last 3+ years, like machinery, computers, vehicles, etc.) are capital-intensive purchases that businesses make when they are confident about future demand.

Ex-aircraft removes commercial aircraft orders, which are very large, volatile, and often placed in batches that distort the underlying trend.

Non-defense strips out military spending, which reflects government policy decisions rather than private-sector investment sentiment.

What remains is a clearer measure of core capital goods orders — essentially, how much U.S. businesses are investing in equipment and tools to expand production. Because business investment is a key driver of GDP growth, this series is tracked as a leading indicator of economic activity and corporate confidence.

So working through the numbers, the 1.1% increase is a positive. However, last month it fell -0.6%, the prior month it rose 1.7%, and the month before that it fell-1.4%. Similar to the value of the dollar, the ups and downs have driven durable goods orders.