- Prior was +0.6%

Details:

- Ex-autos 0.0% vs +0.3% expected

- Prior ex autos +0.5% (revised to +0.4%)

- Ex autos and gas 0.0% vs +0.4% prior(revised to +0.3%)

- Control group -0.1%% vs +0.4% expected

- Prior control +0.4%

- Retail sales y/y +2.1% vs +3.33% prior

USD/JPY was trading down 72 pips to 155.13 prior to this report and I wouldn't expect any improvement. This is a poor headline with soft details and negative revisions.

Here are the details of the report, which shows some strength in clothing and building materials, which have been struggling.

| Category | Nov 2025 ($M) | Dec 2025 ($M) | % Change |

| Retail & Food Services Total | 734,967 | 735,085 | +0.02% |

| Motor Vehicle & Parts Dealers | 139,033 | 138,782 | -0.18% |

| Furniture & Home Furn. Stores | 11,174 | 11,161 | -0.12% |

| Electronics & Appliance Stores | 7,734 | 7,702 | -0.41% |

| Building Material & Garden Eq. | 40,223 | 40,704 | +1.20% |

| Food & Beverage Stores | 85,116 | 85,002 | -0.13% |

| Health & Personal Care Stores | 40,512 | 40,580 | +0.17% |

| Gasoline Stations | 52,973 | 53,127 | +0.29% |

| Clothing & Accessories Stores | 27,298 | 27,431 | +0.49% |

| Sporting Goods, Hobby, Music | 8,349 | 8,379 | +0.36% |

| General Merchandise Stores | 77,376 | 77,291 | -0.11% |

| Miscellaneous Store Retailers | 15,519 | 15,385 | -0.86% |

| Nonstore Retailers | 129,330 | 129,401 | +0.05% |

| Food Services & Drinking Places | 100,374 | 100,229 | -0.14% |

I tend to think that Nov-Dec sales are tough to read because there has been a secular shift to earlier Christmas shopping. That said, Black Friday came late this year so more of those sales should have bled into December than in the past few years. So overall, I see this is a bad look for the US consumer.

Non-farm payrolls are due tomorrow.

The Advance Monthly Retail Sales report, published by the U.S. Census Bureau, provides the earliest monthly snapshot of consumer spending across retail sectors. Released approximately two weeks after the end of each reference month at 8:30 a.m. ET, the report measures sales at retail and food service establishments, adjusted for seasonal variation and holiday and trading-day differences but not for price changes. The data serves as a critical indicator of consumer demand and economic health, tracking thirteen major retail categories from motor vehicles and electronics to food services and nonstore retailers. The report includes both headline retail sales and "retail control" sales, which exclude more volatile categories like autos, gasoline, and building materials, providing a cleaner measure of underlying consumer spending that feeds into GDP calculations.

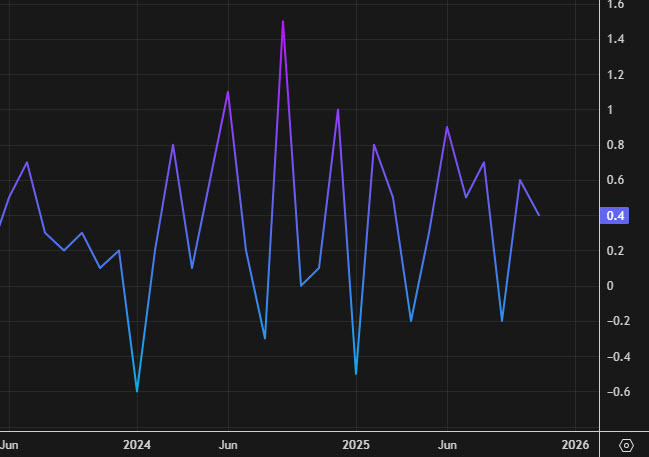

In September 2025, retail sales rose 0.2 percent month-over-month, revised down from an initial 0.4 percent, marking the smallest increase in four months. October saw sales flatten at zero percent growth, falling short of expectations for a 0.1 percent increase, though the decline was largely attributable to a 1.6 percent drop in auto sales as federal electric vehicle tax credits expired. November delivered a stronger rebound with sales rising 0.6 percent, exceeding expectations of 0.5 percent, as holiday shopping gained momentum. Core retail sales—excluding autos—rose 0.4 percent in November while control sales increased 0.3 percent, suggesting sustained consumer resilience despite elevated prices and labor market concerns.