- Prior was +7.1%

- m/m CPI -0.1% vs +0.0% expected

- Prior m/m reading was +0.1%

- Real weekly earnings +0.1% vs +0.2% prior

Core inflation :

- Ex food and energy +5.7% vs +5.7% y/y expected

- Prior ex food and energy +6.0%

- Core m/m +0.3% vs +0.3% exp

- Prior core m/m +0.2%

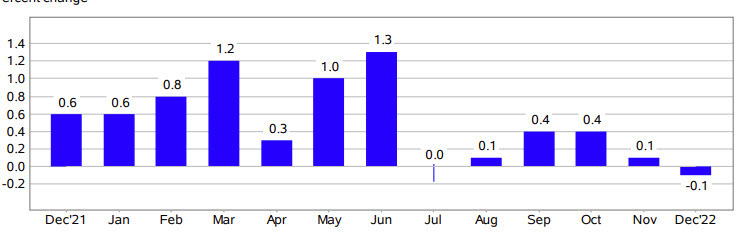

This is the first m/m reading in inflation in more than a year but the market was tilted towards a soft reading and the initial trade is disappointment with stock futures now down 0.5% from +0.3% pre-data.

Details:

- Used cars -2.5% m/m vs -2.9% m/m prior (Goldman Sachs forecast -1.6%)

- Food +0.3% m/m vs +0.5% m/m prior

- Energy -4.5% vs -1.6% m/m prior

- Gasoline -9.4% vs -2.0% m/m prior

- Fuel oil -16.6% m/m +1.7% m/m prior

- New vehicles -0.1% m/m vs 0.0% prior (Goldman forecast -0.5%)

- Apparel +0.5% vs +0.2% prior

- Medical care +0.1% m/m vs 0.2% prior

- Owners equivalent rent +0.8% (Goldman saw +0.64%)

- Airline fares -3.1% (Goldman saw -2.0%)

Shelter prices and core CPI less energy services (some calling it supercore) were up 0.6% on the month as well. CPI ex-food, energy and shelter was -0.1% m/m. You would hope for more of a disinflationary impulse given the cratering in energy prices. That said, the Fed funds market is now more confident in 25 bps at 81% for the Feb 1 meeting and the US dollar is now sinking.

Biden is set to speak on the report at 10 am ET.