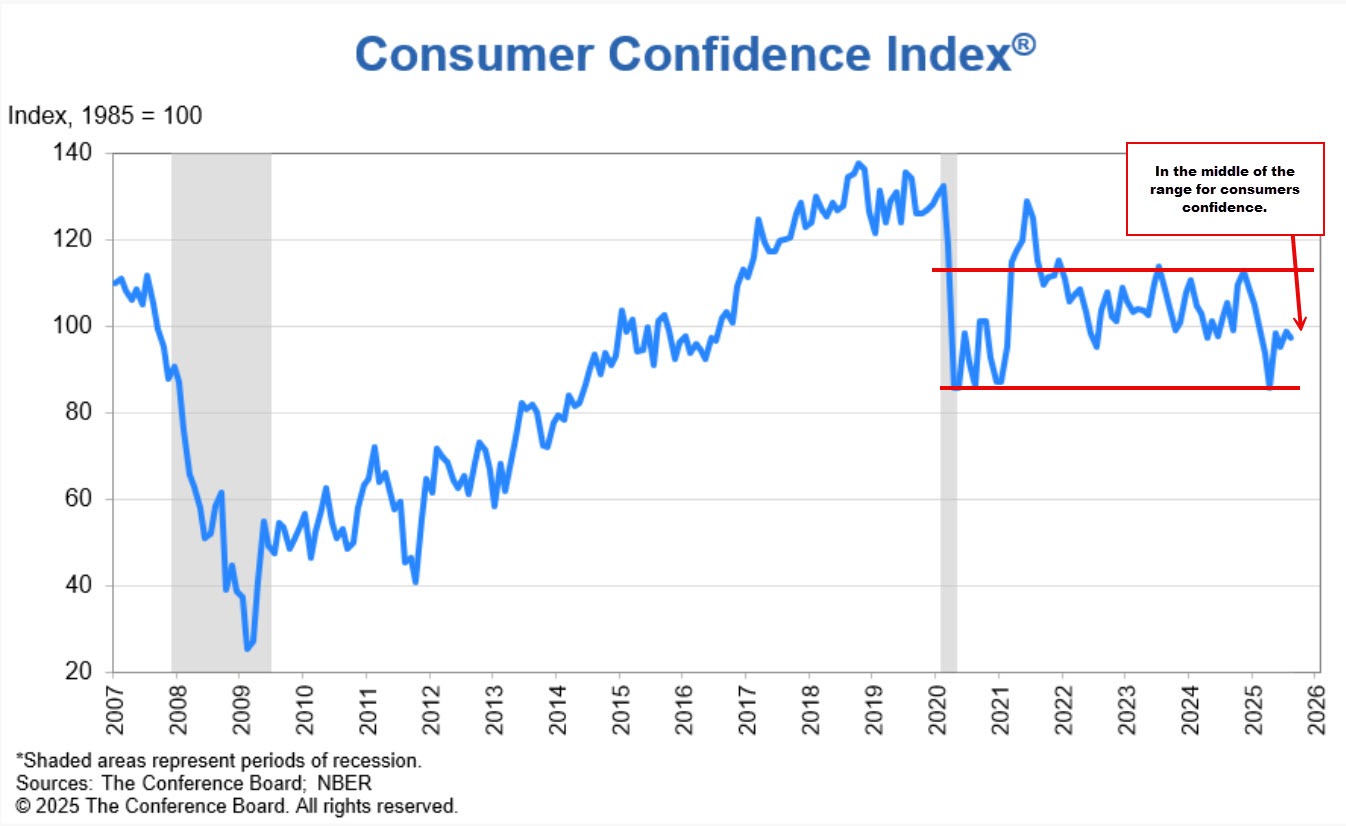

- Prior month 97.2 revised to 98.7

- Consumer's confidence for August 97.4 versus 96.2 estimate

The Current Situation

Business conditions

22.0% said conditions were “good” (up from 20.5% in July).

14.2% said conditions were “bad” (up from 13.6%).

Labor market

29.7% said jobs were “plentiful” (down from 29.9% in July).

20.0% said jobs were “hard to get” (up from 18.9%).

The Expectations (6 months forward) in bullet format:

Business conditions

19.5% expected conditions to improve (up from 19.0% in July).

21.9% expected conditions to worsen (down from 22.7%).

Labor market

17.9% expected more jobs to be available (down from 18.0% in July).

26.8% anticipated fewer jobs (up from 25.1%).

Income prospects

18.3% expected incomes to increase (down from 18.7% in July).

12.6% expected incomes to decrease (up from 11.8%).

Stephanie Guichard, Senior Economist, Global Indicators at The Conference Board

“Consumer confidence dipped slightly in August but remained at a level similar to those of the past three months. The present situation and the expectation components both weakened. Notably, consumers’ appraisal of current job availability declined for the eighth consecutive month, but stronger views of current business conditions mitigated the retreat in the Present Situation Index. Meanwhile, pessimism about future job availability inched up and optimism about future income faded slightly. However, these were partly offset by stronger expectations for future business conditions.”

She added:

“Consumers’ write-in responses showed that references to tariffs increased somewhatand continued to be associated with concerns about higher prices. Meanwhile, references to high prices and inflation, including food and groceries, rose again in August. Consumers’ average 12-month inflation expectations picked up after three consecutive months of easing and reached 6.2% in August—up from 5.7% in July but still below the April peak of 7.0%.”

Visit investingLive.com daily and often (formally forexlive.com)