- PCE core MoM +0.6% vs +0.5% expected

- Prior MoM +0.1%

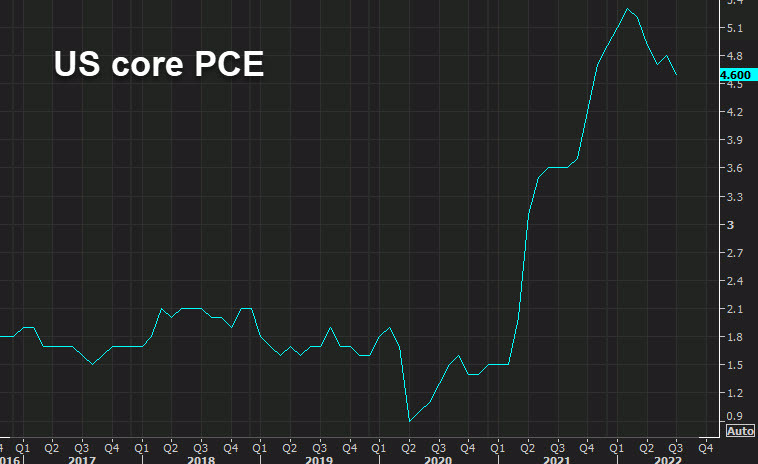

- Core PCE +4.9% y/y vs +4.7% expected

- Prior was 4.6% y/y

- Headline PCE +6.2% y/y vs +6.3% prior (revised to +6.4%)

- Deflator MoM +0.3% vs -0.1% prior

Consumer spending and income for August:

- Personal income +0.3% vs +0.3% expected. Prior month +0.2%

- Personal spending +0.4% vs +0.2% prior

- Real personal spending +0.1% vs +0.2% expected. Prior month +0.1%

Another hot inflation report is not going to be taken well. That said, the hot August CPI report is what kicked off the latest round of risk aversion so high prices in August isn't exactly a shock.

US equities gave up modest gains afte the report while the US dollar strengthened slightly.