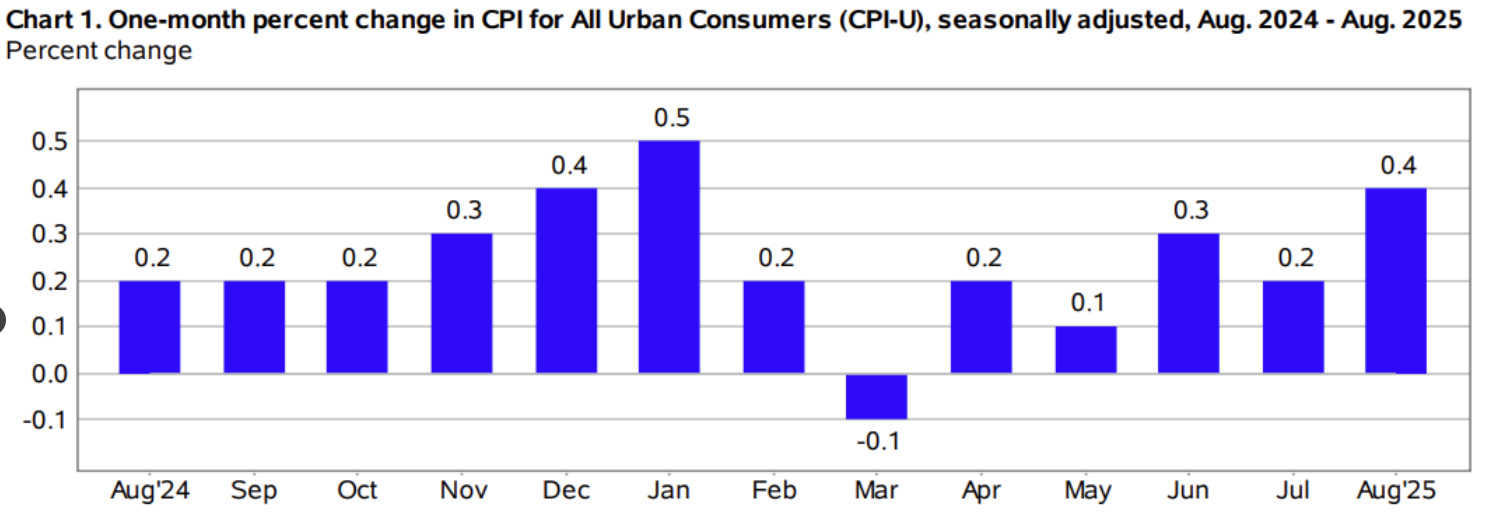

Headline CPI:

- CPI at 2.9% is the highest since January

- Prior was +2.7

- m/m reading at +0.4% vs +0.3% expected (unrounded consensus was +0.36%)

- Month-over-month unrounded % vs +0.287% prior

The rest of the numbers are largely in line.

Core CPI:

- Core CPI +3.1% vs +3.1% expected

- Core CPI m/m +0.3% vs +0.3% expected (some forecasts were +0.27%)

- Core unrounded +0.346% vs +0.228% m/m prior (almost rounded to +0.4%)

- Real weekly earnings -0.1% vs +0.4% prior (revised to +0.1%)

- Core goods prices +0.3% vs +0.2% prior

- Core services +0.3% vs +0.4% prior

- Core services ex shelter +0.2% vs +0.3% prior

- Core-CPI services ex-rent/OER +0.2% vs +0.3% prior

- Services ex energy +0.3% vs +0.4% prior

- Owners equivalent rent +0.4% vs +0.3% prior

The core unrounded number gives this report a touch of a hawkish bent and that likely kills the chance of a 50 basis point cut. I suspect the market was also leaning dovish after yesterday's lower PPI. However if we go further out the curve, the market has priced in about 10 more basis points cuts in easing through 2026, likely to a spike in initial jobless claims today.

In the past three months, there is a pace of inflation that will make it very tough to get below target, and that's in a period when oil prices have been falling.