US CPI core yy

Headline CPI:

- CPI +2.3% vs +2.4% expected -- lowest since Feb 2021

- Prior was +2.4%

- m/m reading at +0.2% vs +0.3% expected

- Month-over-month unrounded +0.221% vs -0.088% prior

Core CPI:

- Core CPI 2.8% vs +2.8% expected

- Core CPI m/m +0.2% vs +0.3% expected

- Core unrounded +0.237% vs +0.116% m/m prior

- Real weekly earnings -0.1% vs +0.3% prior (revised to +0.6%)

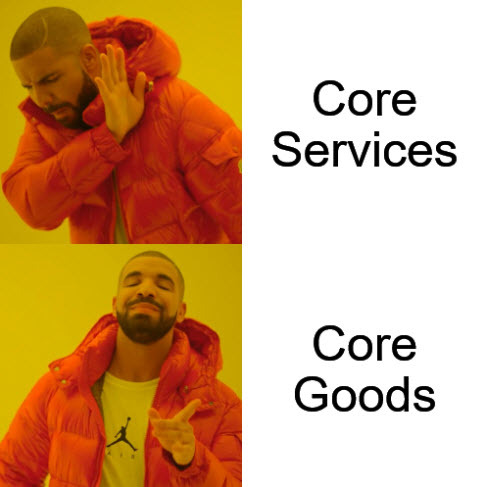

- Core goods prices +0.06% vs -0.09% prior

- Core services +0.317% vs +0.126% prior

- Core services ex shelter +0.287% vs +0.100% prior

- Core-CPI services ex-rent/OER +0.373% vs +0.095% prior

- Services ex energy +0.317% vs +0.160% prior

There was some modest US dollar selling on the headlines but it's mostly retraced.

Shelter rose 0.3%, accounting for more than half of the monthly increase while energy increased 0.7% as natural gas and electricity prices rose to offset a 0.1% decrease in gasoline. The food index fell 0.1%.

Core CPI was 2.1% annualized over the three months through April and 3.0% annualized in the six months.

I think the Fed would have an easy time teeing up a cut right now if not for the tariffs.

Forget housing and insurance, we're onto tariff effects.