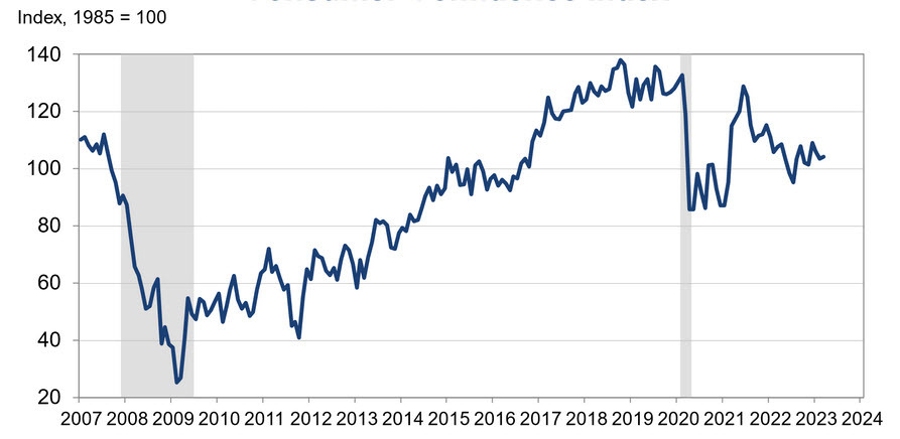

- Prior was 104.2 (revised to 104.0)

- Present situation index 151.1 vs 151.1 prior (prior revised to 148.9)

- Expectations index 68.1 vs 73.0 prior

- 1 year Inflation 6.2% vs 6.3% prior

- Jobs hard-to-get 11.1 vs 10.3 prior

Most Popular

Five9 beats Q4 revenue estimates with 7.8% YoY growth; high CAC payback signals competitive market.

Casella's Q4 EPS beat estimates by 33.6%, but margins dipped. Stock fell 3% post-earnings.

New Zealand January 2026 trade data, exports and imports not as large as in December

AMN Healthcare beats revenue estimates, but EPS misses. Guidance strong, stock jumps 10.8%.

AMH's FFO matches estimates, but revenue misses. Shares down 4% YTD, 13% 12-month.

WSJ reports Trump is weighing a limited strike on Iran to pressure Tehran into a nuclear deal. Initial targeted attacks could come within days, with escalation to broader regime-focused strikes possible if Iran refuses to halt enrichment.

CARG beats revenue estimates with 5.5% YoY growth, but EPS misses. EBITDA guidance is soft.

Must Read