University of Michigan sentiment index for February final:

- Sentiment 56.6 versus 57.3

- current conditions 56.6 versus 57.7

- expectations 56.6 versus 56 6 preliminary

- 5 year inflation 3.3% versus 3.4% preliminary

- 1 year inflation 3.4% versus 3.5% preliminary

From Consumer Director Joanne Hsu

Consumer sentiment stagnated this month with very little change, just 0.2 index points higher than January. All index components posted insignificant movements this month; overall, consumers do not perceive any material differences in the economy from last month. About 46% of consumers spontaneously mentioned high prices eroding their personal finances; readings have exceeded 40% for seven months in a row. Sentiment is about 13% below a year ago and 21% below January 2025. That said, views vary considerably across the population. A sizable month-to-month increase in sentiment for the largest stockholders was fully offset by a decline among consumers without stock holdings. Similar divergences were seen across income and education, where higher-income or college educated consumers exhibited increases in sentiment while lower-income or less-educated counterparts did not. With their much stronger income prospects and investment porfolios, wealthier and higher-income consumers feel better insulated from any possible risks to the economy.

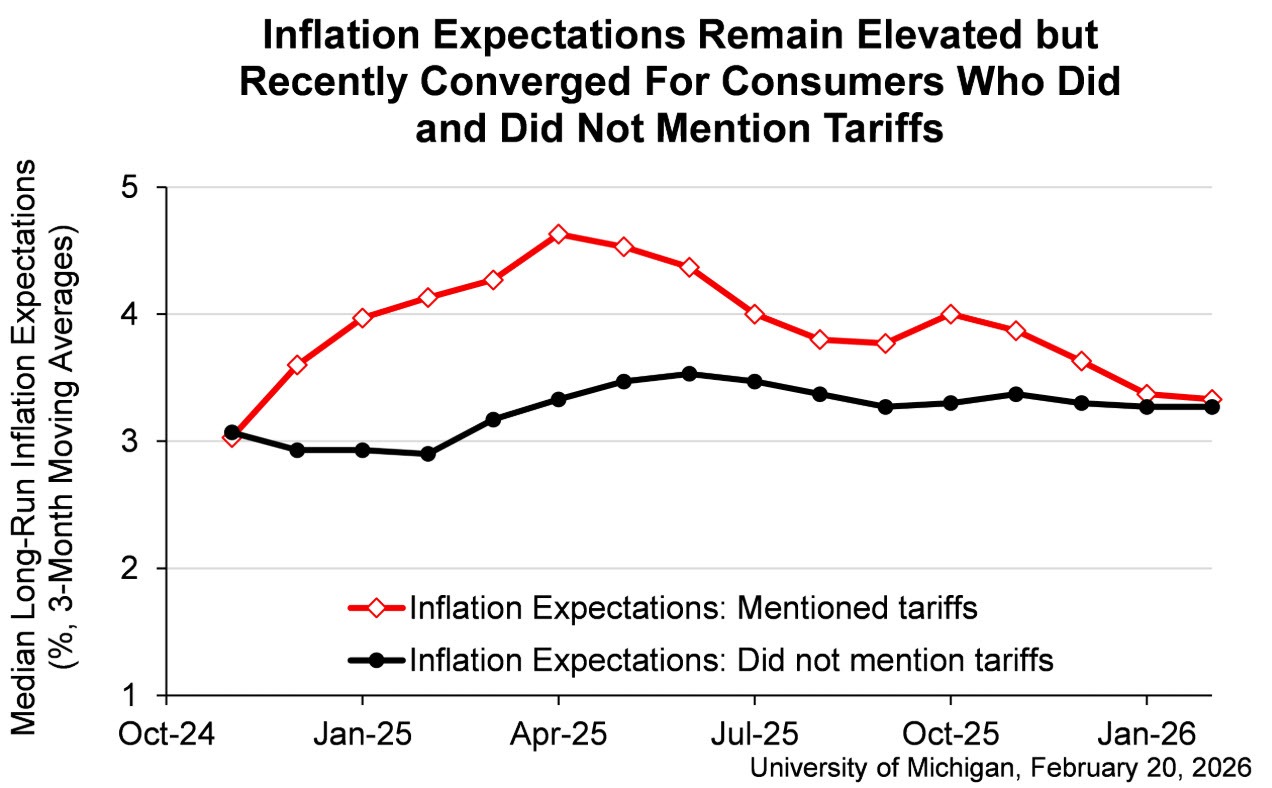

Year-ahead inflation expectations fell from 4.0% last month to 3.4% this month, the lowest reading since January 2025. This month’s reading still exceeds those seen in 2024 and remains well above the 2.3-3.0% range seen in the two years pre-pandemic. Long-run inflation expectations held steady at 3.3%, just above the 2.8% and 3.2% range seen in 2024. In 2019 and 2020, long-run inflation expectations were consistently below 2.8%. Uncertainty, as measured by the middle 50% of expectations, is now its lowest since December 2024 for the short run and October 2024 for the long run.