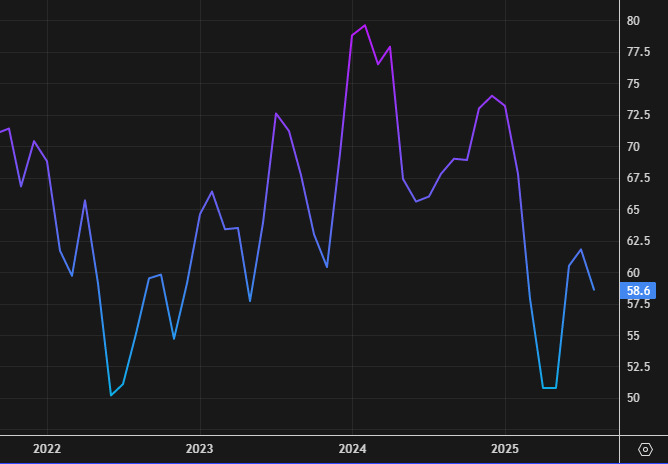

- Prior was 58.2

- Current conditions 61.2 vs 61.3 expected (prior 61.7)

- Expectations 51.8 vs 54.9 expected (prior 55.9)

- 1-year inflation 4.8% vs 4.8% prior

- 5-year inflation 3.9% vs 3.5% prior

The University of Michigan survey was once the gold-standard in confidence surveys but it's been slowly eroded by the politicization of everything and it's more signal than noise at this point. The Fed still watches it and a jump in inflation expectations post-covid caused a bit of a panic at the Fed and a late-signalled jump rate hike but it was later revised away in a bit of an embarrassing moment for policymakers. I'd say that was the nail in the coffin for this being a useful indicator.

There is some moderate US dollar selling on the heels of this report as it shows a poor trajectory, though still with some cushion below the Liberation Day lows.