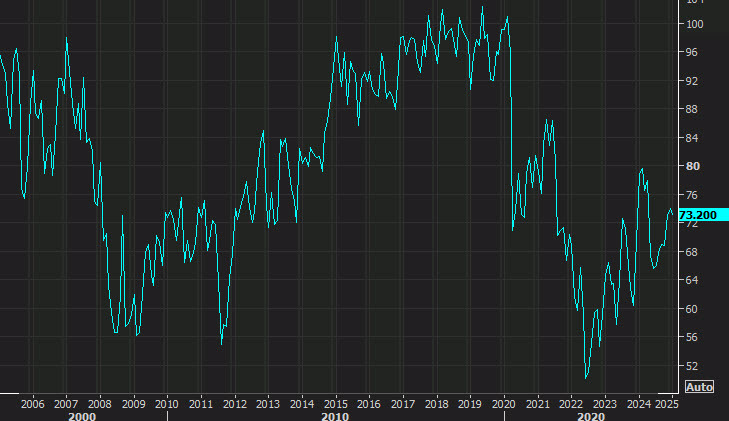

UMich sentiment

- Prior was 74.0

- Current conditions 77.9 vs 75.1 prior

- Expectations 70.2 vs 73.3 prior

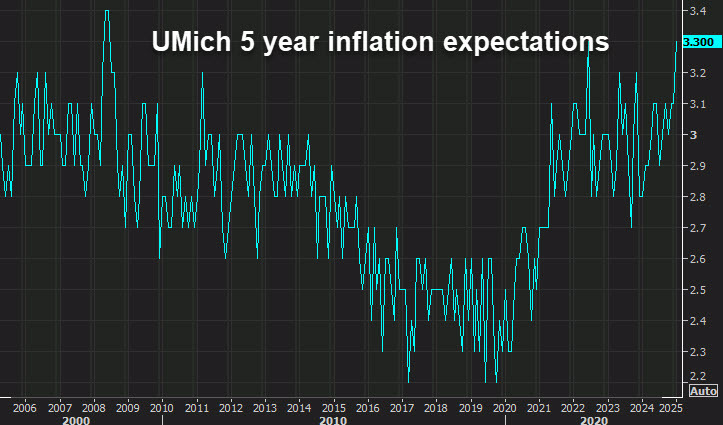

- 1-year inflation 3.3% vs 2.8% prior

- 5-year inflation 3.3% vs 3.0% prior

This is another body blow for stocks, those inflation numbers are a problem though they might reflect expectations about tariffs. This matches the highest since 2008.

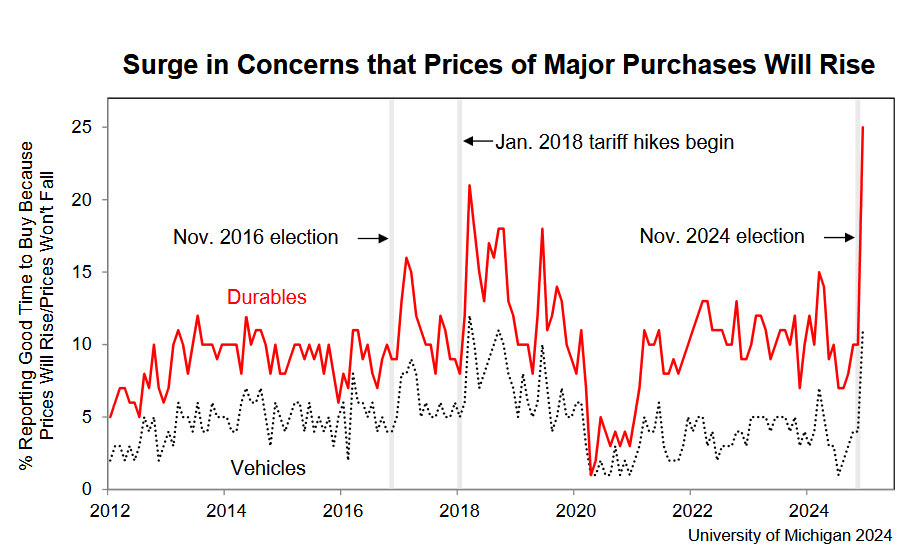

This is an interesting chart from UMich suggesting that the rise in inflation expectations was all about tariffs.