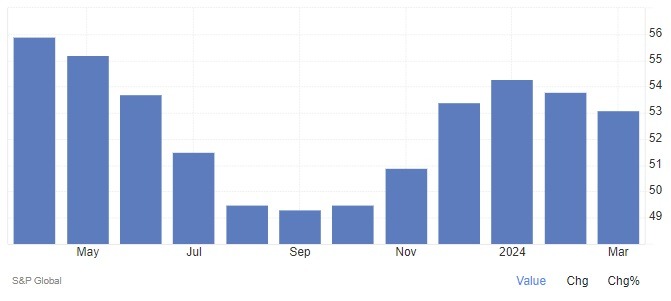

- UK S&P global final services PMI 53.1 vs 53.4 expected

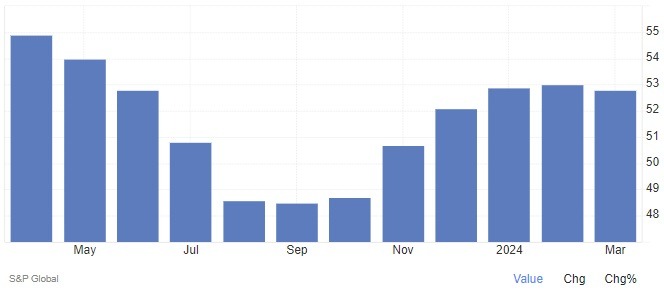

- UK S&P global final composite PMI 52.8 vs 52.9 expected

Comments on the data from S&P:

"The recovery in service sector output lost a little bit of momentum during March, and more so than suggested by the flash PMI results, but the overall picture remains reasonably positive.”

“Business activity has now expanded for five consecutive months, supported by sustained improvements in new order intakes. The solid growth rate achieved in March reinforces the view that a rebound in service sector performance is helping the UK economy to pull out of last year's shallow recession.”

“Survey respondents once again commented on a turnaround in business and consumer spending, despite constraints on clients' budgets from strong inflation and elevated borrowing costs.”

“Input prices continued to rise sharply across the service economy in March, with the rate of inflation only factionally below its average over the past six months. Higher salary payments were the main reason cited as driving up input costs, as well as greater transportation bills.”

“Prices charged by service providers increased at the slowest pace since September 2023. However, this index has only edged downwards since last summer and it remains well above the long-run trend, therefore adding to signs of sticky inflationary pressures in the domestic economy so far this year."