- Prior 54.2

- Manufacturing PMI 46.2 vs 47.1 expected

- Prior 47.0

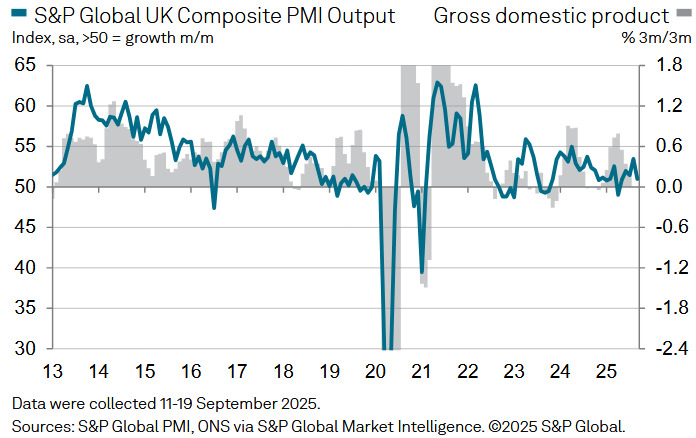

- Composite PMI 51.0 vs 53.0 expected

- Prior 53.5

Key Findings:

- Private sector output expands at slowest pace since May

Comment:

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence:

“September’s flash UK PMI survey brought a litany of worrying news including weakening growth, slumping overseas trade, worsening business confidence and further steep job losses.

"The only good news is perhaps that, just as the Bank of England grows increasingly worried about persistently elevated inflation, the PMI indicated that price pressures have moderated in September. Companies reported one of the smallest increases in prices charged for goods and services seen since the pandemic.

"With the weakening of business activity growth to a rate consistent with the economy almost stalling, and around 50,000 job losses being signalled by the PMI again in the three months to September, alarm bells should be ringing that the economy is faltering, which could help shift the policy debate at the Bank of England back towards a more dovish stance.

"However, amid talk of further tax rises being needed in the Budget later this year, it’s not surprising to see that business expectations have worsened again in September, and in the absence of an improvement in confidence, it’s unlikely that the economy will make any strong gains in the months ahead irrespective of the outlook for interest rates."