- Prior 54.2

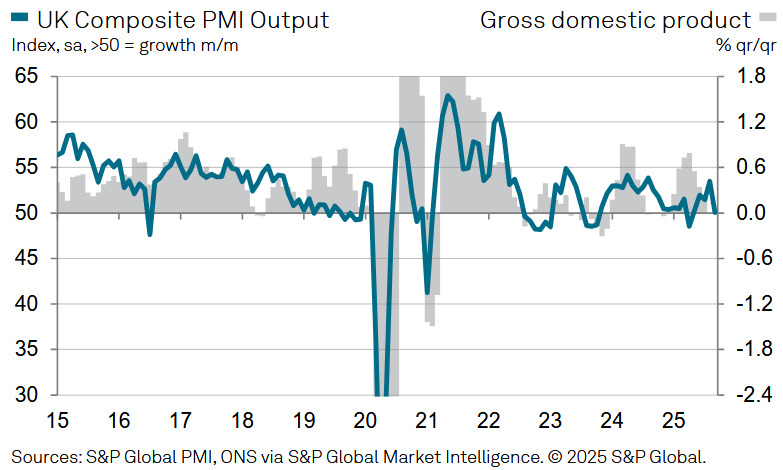

- Final Composite PMI 50.1 vs 51.0 prelim

- Prior 53.5

Key findings:

- Slower increases in output and new orders in September

- Employment falls at faster pace

- Strong input cost inflation persists

Comment:

Tim Moore, Economics Director at S&P Global Market Intelligence, said:

"UK service providers experienced a disappointing end to the third quarter as weak consumer confidence, delays to business spending decisions and falling exports all weighed on demand. Business activity expansion hit a five-month low, while new order gains were much softer than the 11-month high seen in August.

"Consequently, this summer's acceleration in output growth is now looking like a flash in the pan as elevated political and economic uncertainty has reasserted itself as a constraint on service sector performance. Many survey respondents suggested that corporate clients had deferred spending decisions until after the Autumn Budget, while households were also hesitant about major purchases.

"Outside of the UK, service providers were unable to escape challenging market conditions. Total new work from abroad returned to contraction territory in September. Lacklustre demand across Europe was a common theme reported by survey respondents.

"Another round of job cuts followed in the wake of the subdued service sector performance during September, which marked 12 months of falling employment. This was accompanied by softer growth projections for the year ahead and slightly weaker cost pressures. These signals of softening labour market conditions and easing inflationary pressures are likely to provide support to the more dovish shift in the policy debate at the Bank of England."